Managing your savings requires more than just depositing money in the bank. Have you ever wondered what happens to your savings account or fixed deposit if something unexpected occurs? Bank account nomination is a crucial facility that ensures your loved ones can access your funds without navigating complex legal processes during a difficult time.

The Reserve Bank of India (RBI) and the Ministry of Finance have recently introduced significant updates to nomination guidelines. These changes, effective from November 1, 2025, modernize the entire nomination process and make it more customer-friendly. Understanding these new bank account nomination rules can help protect your family from unnecessary delays and complications.

What Is a Nomination in a Bank Account?

Nomination is essentially a safety net for your family. When you nominate someone for your bank account, you designate a trusted person who can claim your funds after your death. The nominee acts as a trustee—someone who receives the money on behalf of your legal heirs.

Without a nominee, your family members must obtain succession certificates or court orders to access funds from your account. This process can take months and cause significant financial hardship during an already emotional period. Bank account nominations are available for savings accounts, current accounts, fixed deposits, recurring deposits, and even proprietorship accounts.

Key Changes in Bank Account Nomination Rules

The Banking Companies (Nomination) Rules, 2025, replaced the outdated 1985 rules, representing a major modernization of India’s banking system.

Up to Four Nominees Allowed

The most significant change is that account holders can now nominate up to four individuals for deposit accounts and safe deposit lockers. You have two options:

Simultaneous Nomination: Distribute your deposit among nominees by assigning specific percentages to each. For example, allocate 40% to your spouse and 30% each to your children.

Successive Nomination: List nominees in priority order. The bank settles claims with the first nominee, and if unavailable, moves to the next.

Digital Nomination and Security

Banks can now offer secure e-nomination through internet and mobile banking platforms. E-nomination requires proper authentication through electronic signatures, two-factor verification, or other secure methods. Banks must send instant SMS or email alerts whenever nominations are made or modified.

Bank Compliance Requirements

The RBI issued directions on October 28, 2025, requiring all commercial and cooperative banks to fully comply with new rules effective November 1, 2025. Banks must inform customers about nomination facilities when opening accounts and cannot refuse to open accounts simply because customers decline to nominate.

Banks must acknowledge nomination requests within three working days and have standardized procedures for processing changes.

How to Add or Modify a Nomination

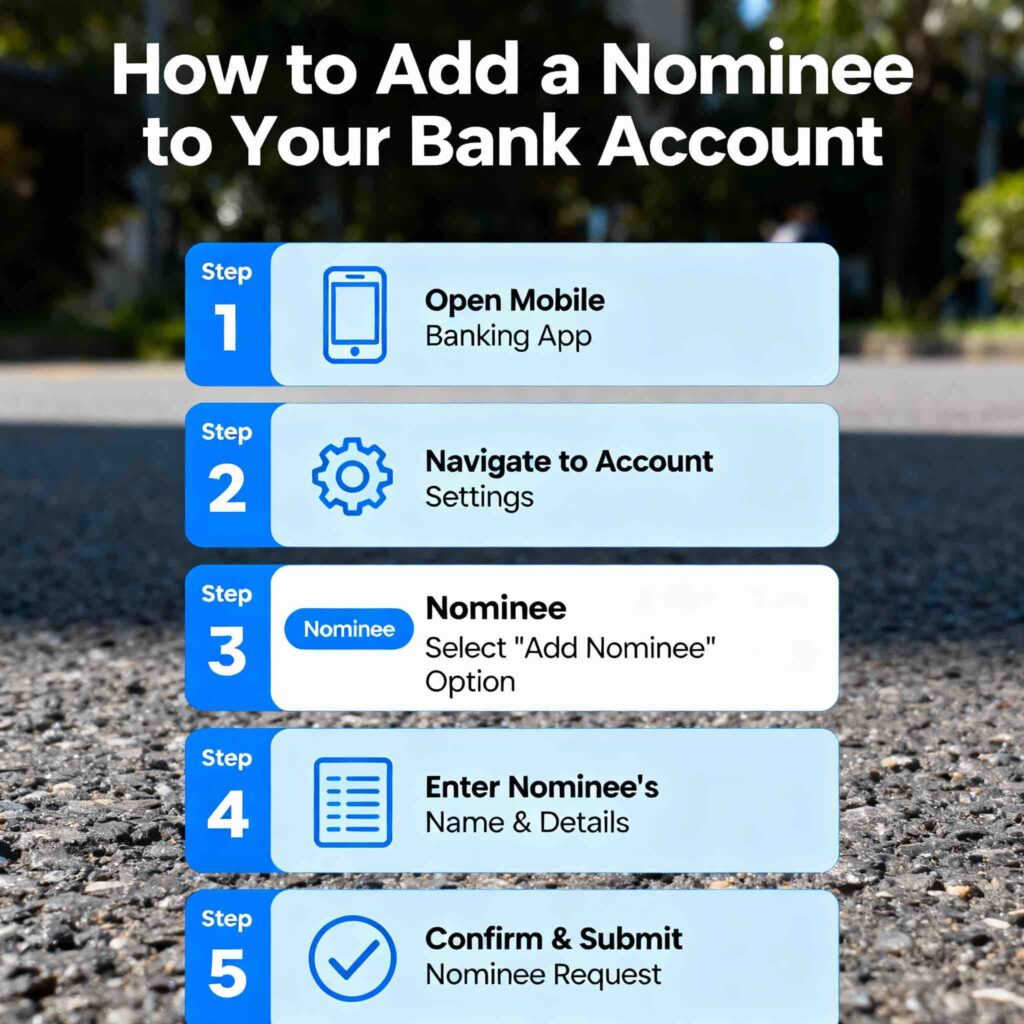

Online Process

Most banks allow you to update nominees through internet banking or mobile apps:

- Log in to your net banking account

- Navigate to “Accounts” or “Services” section

- Select “View/Update Nomination Details”

- Choose your account and fill in nominee information

- Specify simultaneous or successive nomination preference

- Submit and receive confirmation within three working days

Traditional Methods

Visit your nearest bank branch with required forms. Use standardized nomination forms: Form DA1for fresh registration, Form DA2 for cancellation, and Form DA3 for modifications.

Important Tips

Review your nominations during major life changes—marriage, birth of children, or divorce. Keep nominee contact details current, and inform your nominee about the arrangement to avoid confusion.

Why These Changes Matter

Faster Claim Settlement

The RBI’s Settlement of Claims Directions, 2025, enables quick claim processing for accounts with valid nominations. Nominees only need to submit a claim form, death certificate, and identity proof—no succession certificates required.

For accounts without nominees, the new rules simplify the process for claims up to ₹15 lakh, requiring only basic documentation and no-objection letters from heirs.

Benefits for Joint Accounts and Senior Citizens

Joint account holders benefit from survivorship clauses—the surviving holder can access funds immediately. For senior citizens, clear nomination rules provide peace of mind that life savings reach intended beneficiaries without delays.

Real-World Impact

Consider Mrs. Sharma, a 68-year-old retiree with ₹25 lakh in fixed deposits. She nominated her two daughters with a 50-50 split. When she passed away, her daughters accessed their shares within a week with just a death certificate and identity proof.

Compare this to Mr. Verma, who died without a nominee on his ₹12 lakh fixed deposit in 2024. His family engaged lawyers, obtained court succession certificates (taking six months), and incurred ₹40,000 in legal expenses before accessing the funds.

Conclusion

The new bank account nomination rules represent a progressive modernization of India’s banking system. From allowing four nominees to enabling secure digital nomination through mobile banking, these reforms prioritize convenience, transparency, and customer empowerment.

These guidelines ensure your family’s financial security during difficult moments. The streamlined claim settlement process and reduced documentation make it easier than ever to protect your loved ones.

Update your bank nominations today—whether online or at your branch. Review your nominations whenever major life changes occur. While nomination remains voluntary, it’s one of the wisest financial decisions you can make. The RBI has simplified the process, so take action now to spare your family from future bureaucratic complications.

- Is Your Credit Card Quietly Killing Your Score? The 30% Factor Lenders Watch CloselyCredit utilization ratio can quietly make or break your CIBIL score. Keeping card usage below 30% signals control, not desperation. With simple moves—mid‑cycle payments, spreading spends, and requesting higher limits—you can boost approval odds and pay less interest overall today.

- Need a Loan? Use These 7 No-Gimmick Tactics to Fix Your CIBIL Score in Just 30 DaysBoost your CIBIL score by 50+ points in just 30 days with proven tactics. Master payment history, reduce credit utilization, and dispute errors to unlock better loan approvals and lower interest rates. No gimmicks—just real strategies that work.

- Union Bank, BOI, and IOB: The Next Mega-Merger Wave is Coming. Here’s How Your Savings & Account Details Will ChangeIndia’s public sector banking faces a transformative merger wave. Finance Minister Sitharaman confirmed talks with RBI on consolidating 12 banks into six to seven globally competitive institutions. Expected announcements in April-May 2026 will reshape banking operations, employee roles, and customer services fundamentally.

- Don’t Panic: Why Your Bank’s Website Address Just Changed (and How to Tell if It’s Real)The Reserve Bank of India mandated all Indian banks migrate to the exclusive .bank.in domain by October 31, 2025, to combat rising digital fraud. This restricted domain provides verified security, SSL encryption, and DNSSEC protection, making it significantly harder for cybercriminals to create fake banking websites and phishing scams targeting unsuspecting customers.

- Why a Tiny $2.00 Bank Charge Could Be Your Biggest Warning SignReviewing your bank statements regularly and reporting lost cards immediately are your most powerful weapons against fraud. When you catch unauthorized transactions early, you’re already ahead of most fraudsters. Consumer fraud losses exceeded $12.5 billion in 2024, making vigilant account monitoring essential for protecting your financial security.

- Your ‘Backup’ Account Could Be Frozen This Month: The 1-Minute Move to Prevent a Banking LockoutDormant bank accounts expose you to fraud, identity theft, and financial loss. Discover how to keep your account active, prevent dormancy risks, reactivate frozen accounts, and protect your money from unauthorized access with RBI-compliant strategies.

- No More Bank Queues: How to Submit Your Jeevan Pramaan Using Just Your PhoneGovernment pensioners must submit their life certificate between November 1-30, 2025, to ensure uninterrupted pension payments. The simple online submission takes just 5 minutes via fingerprint authentication, or visit your bank branch. Missing the deadline stops your pension—submit today.

- New RBI Nomination Rules Are Now Live: The Simple Change to Prevent Your Funds From Being LockedThe RBI’s new bank account nomination rules 2025 allow up to four nominees with digital registration. Learn how these changes simplify claim settlement, protect your family’s financial security, and why updating your nomination matters today.

- Pride of India: The Surprising Global Title SBI Just Snatched From International GiantsState Bank of India wins Global Finance Awards 2025 for World’s Best Consumer Bank and Best Bank in India. Discover how SBI’s digital-first strategy through YONO, 520 million customer base, and financial inclusion leadership earned this prestigious global recognition.

- Mobile Signal Just Dropped? The ‘Silent’ Banking Scam That Can Empty Your Account Without a PasswordDiscover how to detect and prevent banking frauds like phishing, vishing, and ATM skimming. Learn practical tips—enable two-factor authentication, monitor transaction alerts, secure devices—and follow a concise, effective checklist. Report suspicious activity promptly to safeguard your finances and banking security.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for your feedback! Please reach me at avpatra09@gmail.com.