“I can’t afford to invest” – sounds familiar? What if I told you that just ₹250 per month – less than your daily coffee budget could potentially create a corpus worth ₹1.5 crores over 30 years? Welcome to the revolutionary world of micro-SIPs, where small amounts create big dreams.

Picture this: Arjun, 25, earns ₹30,000 monthly as a junior software developer in Pune. After rent, food and EMIs, he barely saves ₹2,000. Traditional financial advice suggests investing ₹5,000-10,000 monthly – clearly out of his reach. But what if there was a smarter way?

Enter the ₹250 SIP Empire strategy – a game-changing approach that’s quietly transforming how young Indians build wealth. Instead of waiting to save “enough,” you start with what you have and let the magic of compounding work for decades.

The Science Behind ₹250: Why Micro-SIPs Work

The Association of Mutual Funds in India (AMFI) reports over 8.64 crore active SIP accounts as of June 2025 with micro-SIPs of ₹250-₹500 driving 40% of new registrations. This isn’t just a trend – it’s a financial revolution happening in Tier-2 and Tier-3 cities where young professionals are discovering the power of starting small.

The Psychology of ₹250:

- Affordability: Everyone can spare ₹8.30 daily (₹250 ÷ 30 days)

- Consistency: Lower amounts are easier to maintain during tough months

- Growth mindset: Creates habit first, wealth follows naturally

The ₹250 SIP Empire Strategy: Three Funds with Maximum Impact

Instead of putting all ₹250 in one fund, smart investors split it across three complementary funds to balance growth, stability and tax benefits.

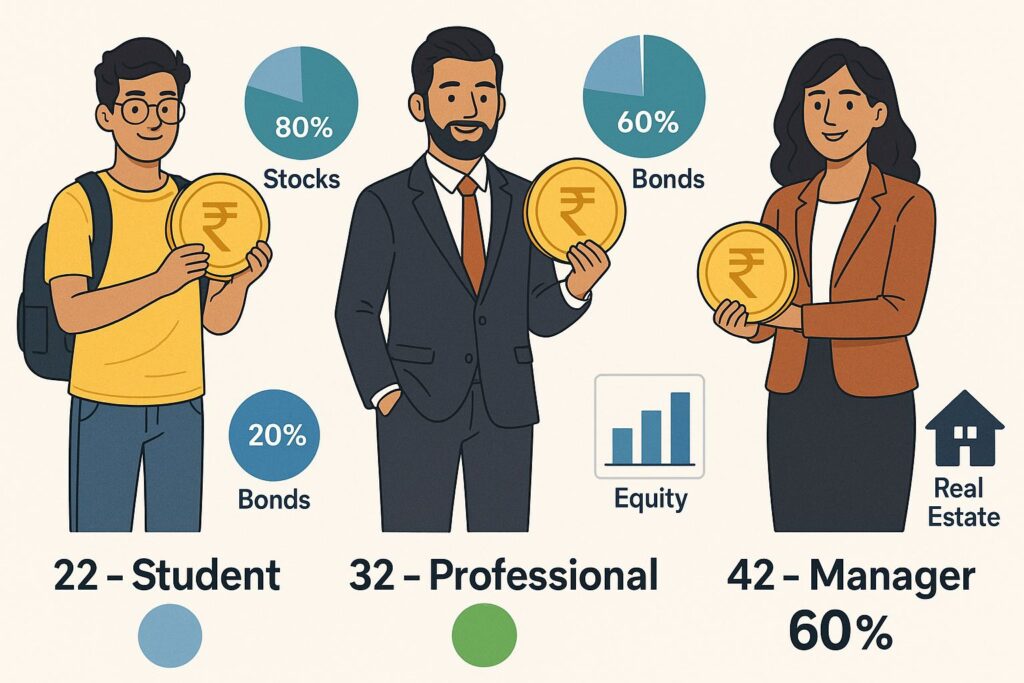

Optimal ₹250 SIP portfolio allocation strategies for different age groups, balancing growth potential with risk management

Fund Selection by Age & Risk Profile:

For 20-Year-Olds (High Risk, High Reward):

- ₹175 (70%): Small & Mid Cap funds – targeting 15-18% returns

- ₹50 (20%): Large Cap funds – providing stability at 12-14% returns

- ₹25 (10%): ELSS funds – tax saving under Section 80C

For 30-Year-Olds (Balanced Growth):

- ₹125 (50%): Large Cap funds – steady 12-14% returns

- ₹75 (30%): Small & Mid Cap funds – growth potential

- ₹50 (20%): ELSS funds – increased tax planning focus

For 40-Year-Olds (Stability Focus):

- ₹150 (60%): Large Cap funds – consistent performance

- ₹62 (25%): Hybrid/Balanced funds – moderate risk

- ₹38 (15%): ELSS funds – tax efficiency

Real-World Examples: Meet Our SIP Warriors

Priya (22, Marketing Executive, Jaipur)

Monthly Investment: ₹250 across 3 funds

Income: ₹25,000 monthly

Goal: Financial independence by 45

Portfolio Split:

- Axis Small Cap Fund: ₹175 (targeting 16% returns)

- HDFC Large Cap Fund: ₹50 (targeting 13% returns)

- Mirae Asset ELSS Fund: ₹25 (targeting 14% returns)

Rohit (32, Government Teacher, Bhopal)

Monthly Investment: ₹250 across 3 funds

Income: ₹35,000 monthly

Goal: Children’s education and retirement

Portfolio Split:

- SBI Large Cap Fund: ₹125 (targeting 13% returns)

- Kotak Mid Cap Fund: ₹75 (targeting 15% returns)

- Axis ELSS Fund: ₹50 (targeting 14% returns)

Meera (42, Bank Manager, Coimbatore)

Monthly Investment: ₹250 across 3 funds

Income: ₹55,000 monthly

Goal: Early retirement and daughter’s wedding

Portfolio Split:

- ICICI Prudential Large Cap: ₹150 (targeting 12% returns)

- HDFC Balanced Fund: ₹62 (targeting 11% returns)

- UTI ELSS Fund: ₹38 (targeting 13% returns)

The Numbers Game: ₹250 SIP Wealth Projections

Based on historical mutual fund performance averaging 12-15% for equity funds and average inflation of 5.8%, here are realistic projections:

Priya’s 20-Year Journey (Age 22-42)

Expected blended return: 15% annually

Total investment: ₹60,000 (₹250 × 12 × 20)

Results:

- Maturity Value: ₹6.12 lakhs

- Wealth created: ₹5.52 lakhs

- Inflation-adjusted value: ₹3.95 lakhs (in today’s money)

Rohit’s 25-Year Journey (Age 32-57)

Expected blended return: 14% annually

Total investment: ₹75,000 (₹250 × 12 × 25)

Results:

- Maturity Value: ₹12.85 lakhs

- Wealth created: ₹12.10 lakhs

- Inflation-adjusted value: ₹7.89 lakhs (in today’s money)

Meera’s 15-Year Journey (Age 42-57)

Expected blended return: 12% annually

Total investment: ₹45,000 (₹250 × 12 × 15)

Results:

- Maturity Value: ₹2.25 lakhs

- Wealth created: ₹1.80 lakhs

- Inflation-adjusted value: ₹1.64 lakhs (in today’s money)

The Step-Up Secret: Supercharging Your ₹250 Empire

The real magic happens when you increase your SIP by 10% annually – mimicking salary increments and beating inflation.

Step-Up SIP Example: Priya’s Enhanced Strategy

Starting SIP: ₹250

Annual increment: 10%

Duration: 20 years

Expected return: 15%

| Year | Monthly SIP | Annual Investment | Corpus Value |

|---|---|---|---|

| 1-2 | ₹250 | ₹3,000 | ₹6,450 |

| 5 | ₹366 | ₹4,392 | ₹42,850 |

| 10 | ₹593 | ₹7,116 | ₹1,89,650 |

| 15 | ₹959 | ₹11,508 | ₹5,45,200 |

| 20 | ₹1,553 | ₹18,636 | ₹12,84,500 |

With step-up: ₹12.85 lakhs vs ₹6.12 lakhs (regular SIP) – 110% more wealth!

Inflation Reality Check: What Your Money Will Actually Buy

Let’s be honest about inflation impact. At 5.8% average inflation:

₹6.12 lakhs after 20 years equals:

- Today’s buying power: ₹3.95 lakhs

- What it can buy: Mid-range car, home down payment in Tier-2 city

- Monthly income at 7% withdrawal: ₹2,125 (inflation-adjusted)

Why it still matters:

- Emergency fund: 2-3 years of current expenses covered

- Goal funding: Child’s education, wedding or home renovation

- Investment seed: Capital to start bigger investments

- Financial confidence: Proof that you can build wealth systematically

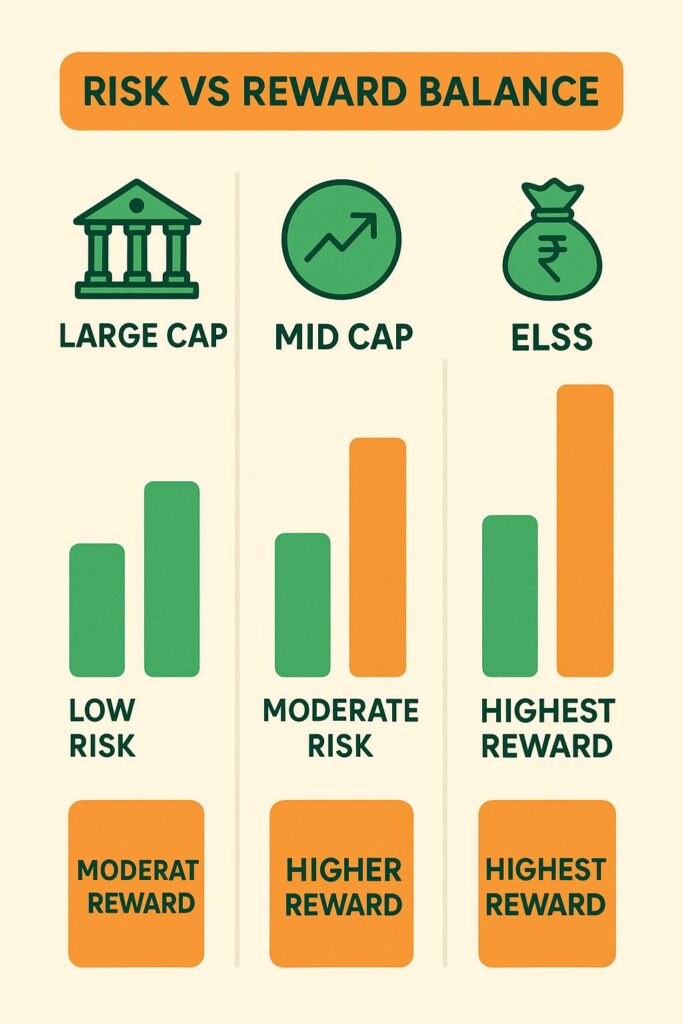

Risk Management: The Smart Way to Balance Your ₹250

Common Mistakes to Avoid:

❌ Putting all ₹250 in one high-risk fund

✅ Diversifying across 3 fund categories

❌ Chasing last year’s best performer

✅ Sticking to consistent, well-managed funds

❌ Stopping SIP during market falls

✅ Continuing through market cycles for rupee-cost averaging

Risk Mitigation Strategies:

- Geographic diversification: Choose funds investing across sectors

- Time diversification: Different SIP dates (1st, 10th, 20th) for better averaging

- Fund house diversification: Don’t put all funds with same AMC

- Regular review: Annual portfolio rebalancing

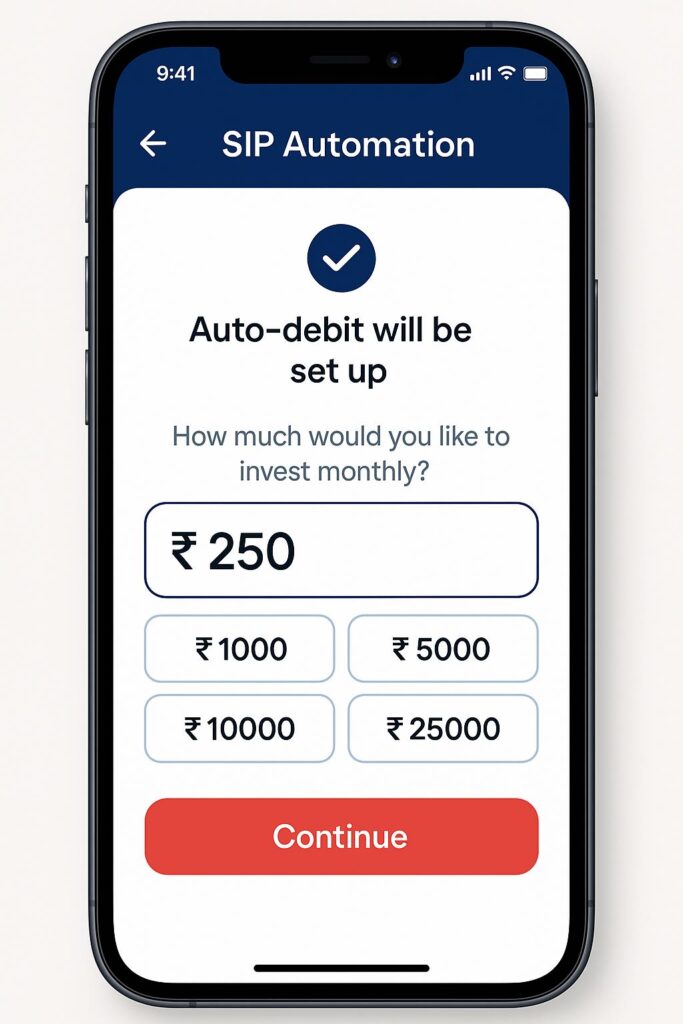

The Automation Advantage: Set It and Forget It

Technology Tools for ₹250 SIP Success:

- Groww/Zerodha Coin: Zero-commission direct funds

- Paytm Money/ET Money: User-friendly interfaces for beginners

- Auto-debit setup: Ensures consistency without manual intervention

- Step-up automation: Automatic 10% annual increases

Monthly Maintenance Routine:

- Auto-debit verification: Ensure sufficient balance on SIP dates

- Performance tracking: Monthly NAV monitoring (don’t panic on volatility)

- Goal alignment: Quarterly check on progress vs targets

- Annual review: Fund performance vs benchmark comparison

Tax Benefits: Your ₹250 Triple Advantage

ELSS Component Benefits (₹25-50 of your ₹250):

- Section 80C deduction: Up to ₹1.5 lakh annually

- Tax savings: ₹4,650-15,600 annually (depending on tax bracket)

- Lock-in period: Only 3 years vs 5-15 years for other 80C options

- Growth potential: Historical returns of 12-16%

Long-term Capital Gains (for equity funds):

- Tax-free up to ₹1 lakh per year on LTCG

- 10% tax beyond ₹1 lakh (vs 30% on short-term gains)

- Indexation benefits: Further tax optimization

When ₹250 Isn’t Enough: The Graduation Strategy

Phase 1 (Months 1-12): Build the ₹250 habit

Phase 2 (Year 2): Step-up to ₹275 (10% increase)

Phase 3 (Year 3-5): Add another ₹250 SIP in different fund

Phase 4 (Year 5+): Graduate to ₹1,000+ SIPs while maintaining original ₹250

Income-Based Scaling:

- ₹25,000 salary: Stick to ₹250 (1% of income)

- ₹40,000 salary: Scale to ₹500 (1.25% of income)

- ₹60,000 salary: Reach ₹1,000 (1.7% of income)

Real Success Stories: ₹250 SIP Champions

Case Study 1: Amit (Now 35, Started at 23)

Journey: 12 years of ₹250 SIP with 8% annual step-ups

Current Value: ₹2.1 lakhs

Impact: Used for wedding down payment, now runs ₹2,000 SIPs

“That ₹250 taught me money discipline. Today I invest ₹25,000 monthly across different assets, but it all started with that tiny SIP.” – Amit

Case Study 2: Kavya (Now 38, Started at 28)

Journey: 10 years of ₹250 SIP, increased to ₹500 after promotion

Current Value: ₹1.8 lakhs

Impact: Funded daughter’s school admission, continuing for retirement

“My friends laughed at ₹250 SIP. Today, they ask me for investment advice. Small steps, big dreams!” – Kavya

The Compounding Magic: Why Starting at 22 vs 32 Matters

Scenario: ₹250 monthly SIP for 25 years at 14% returns

Starting at 22 (till 47):

- Total investment: ₹75,000

- Maturity value: ₹12.85 lakhs

- Wealth multiplier: 17.1x

Starting at 32 (till 57):

- Total investment: ₹75,000

- Maturity value: ₹12.85 lakhs

- Wealth multiplier: 17.1x

Starting at 42 (15 years till 57):

- Total investment: ₹45,000

- Maturity value: ₹2.25 lakhs

- Wealth multiplier: 5x

Key Insight: Every 10-year delay costs you ₹10+ lakhs in potential wealth!

Market Reality Check: Managing Expectations

Historical Performance Reality:

- Best-performing large-cap funds: 13-15% over 10 years

- Market volatility: Expect 2-3 negative years in every 10-year period

- Economic cycles: Bull markets (3-5 years) followed by corrections

- Inflation impact: Real returns typically 6-9% after inflation

Worst-Case Scenarios:

- Market crash years (2008, 2020): Portfolio may drop 30-40%

- Sector rotation: Mid/small caps can fall 50%+ in corrections

- Fund manager changes: Performance may vary with management

- Regulatory changes: Tax rules, fund categorization impacts

Best-Case Scenarios:

- Bull market years: 25-40% annual returns possible

- Sector booms: Specific themes may deliver 50%+ returns

- Compounding acceleration: Later years show exponential growth

The ₹250 SIP Empire Commandments

Golden Rules for Success:

- Start today, not tomorrow – Time is your biggest ally

- Automate everything – Remove emotions and manual intervention

- Ignore short-term noise – Focus on 5+ year periods

- Increase annually – 10% step-ups beat inflation and build discipline

- Diversify wisely – 3 funds across risk spectrum

- Review annually – Not monthly or daily

- Stay the course – Don’t stop during market falls

- Graduate gradually – Add more SIPs as income grows

Red Flags to Avoid:

❌ Stopping SIP during market corrections

❌ Frequently switching between funds

❌ Investing based on tips from friends/social media

❌ Putting emergency fund in equity SIPs

❌ Expecting linear returns (markets are cyclical)

❌ Comparing with fixed deposit returns in bull markets

❌ Panic selling during 30%+ portfolio drops

Your ₹250 Empire Action Plan

Week 1: Foundation Setup

- Day 1-2: Complete KYC with any fund house

- Day 3-4: Research and select 3 funds based on age profile

- Day 5-6: Set up auto-debit for ₹250 (split ₹100+₹100+₹50 or similar)

- Day 7: Schedule first SIP dates (1st, 10th, 20th of month)

Month 1: Habit Formation

- Track first 3 SIP debits

- Monitor NAV movements (but don’t panic)

- Read about selected fund managers and strategies

- Set calendar reminder for annual review

Year 1: Discipline Building

- Complete 12 successful SIP cycles

- Review overall portfolio performance

- Plan 10% step-up for Year 2

- Consider adding second ₹250 SIP if income grows

Years 2-5: Wealth Acceleration

- Graduate to ₹500-1,000 monthly SIPs

- Add lump-sum investments during market corrections

- Explore other asset classes (PPF, NPS, real estate)

- Maintain original ₹250 SIP as base discipline

The Bottom Line: Why ₹250 Changes Everything

The ₹250 SIP Empire isn’t about becoming crorepati overnight. It’s about building the discipline, knowledge, and confidence that creates lasting wealth.

What ₹250 monthly really buys you:

- Financial discipline: The habit of consistent investing

- Market education: Real-world experience with volatility

- Compounding confidence: Seeing money grow builds investment appetite

- Goal achievement: Tangible corpus for life milestones

- Inflation protection: Equity returns historically beat inflation

- Tax benefits: Legal tax savings through ELSS component

The Mindset Shift: From “I can’t afford to invest” to “I can’t afford NOT to invest.”

Remember: Every financial giant started with small steps. Warren Buffett’s first stock purchase was just $38. Rakesh Jhunjhunwala began with ₹5,000. Your ₹250 SIP empire might seem tiny today, but with 20-30 years of patience and discipline it can fund your dreams, secure your family’s future and give you the financial confidence to take bigger and bolder investment decisions.

The question isn’t whether ₹250 can make you rich – it’s whether you’ll start today or regret tomorrow.

Your empire awaits. Start building, one ₹250 SIP at a time.

Disclaimer: Mutual fund investments are subject to market risks. Past performance doesn’t guarantee future returns. The projections are based on historical averages and may not reflect actual future performance. Please consult a financial advisor for personalized investment advice.

- Sunita Williams’ Secret: Astronaut Mindset That Builds Crores via SIP InvestingDiscover Sunita Williams’ astronaut mindset for wealth building: Solve crises “one bite at a time” like mutual fund SIP investing. Learn disciplined saving, risk pivots, and best mutual funds India strategies from her 27-year NASA career.

- The ₹1 Magic: Transform Pocket Change Into ₹1,378 With This Simple 52-Week PlanTransform your finances with India’s most popular 52-week money challenge. Save just ₹1 in week one, building to ₹52 by year-end for a total of ₹1,378. Discover the reverse challenge, practical tips, and how consistent saving habits create lasting financial freedom.

- Forget 10% Salaries: Why 48% of India’s Gen Z are Starting SIPs with Just ₹500Discover how India’s Gen Z is building wealth with just ₹500 monthly SIPs. From ₹3 trillion in SIP inflows to 100 million active accounts, young investors are leveraging compound interest and disciplined investing to achieve financial independence without hefty salaries or trust funds.

- Is Your Credit Card Quietly Killing Your Score? The 30% Factor Lenders Watch CloselyCredit utilization ratio can quietly make or break your CIBIL score. Keeping card usage below 30% signals control, not desperation. With simple moves—mid‑cycle payments, spreading spends, and requesting higher limits—you can boost approval odds and pay less interest overall today.

- Need a Loan? Use These 7 No-Gimmick Tactics to Fix Your CIBIL Score in Just 30 DaysBoost your CIBIL score by 50+ points in just 30 days with proven tactics. Master payment history, reduce credit utilization, and dispute errors to unlock better loan approvals and lower interest rates. No gimmicks—just real strategies that work.

Pingback: How to Create Your First Budget as a Young Professional: A Complete Guide – Banker Money

Exactly, start investing immediately, it’s not about the amount you invest but the consistency, persistence and discipline makes the difference. Thanks for the input.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://bankermoney.com

Your article helped me a lot, is there any more related content? Thanks! https://bankermoney.com

Pingback: Robo-Advisors vs Human Advisors: Complete 2026 Guide

Pingback: Build Wealth with ₹500 SIP: The Gen Z Strategy