Tired of paying for everything without getting anything back? What if I told you that your daily chai, groceries and even rent payments could put money back in your pocket? Welcome to the world of UPI cashback stacking—where smart Indians are quietly earning ₹8,000-15,000 annually just by changing how they pay.

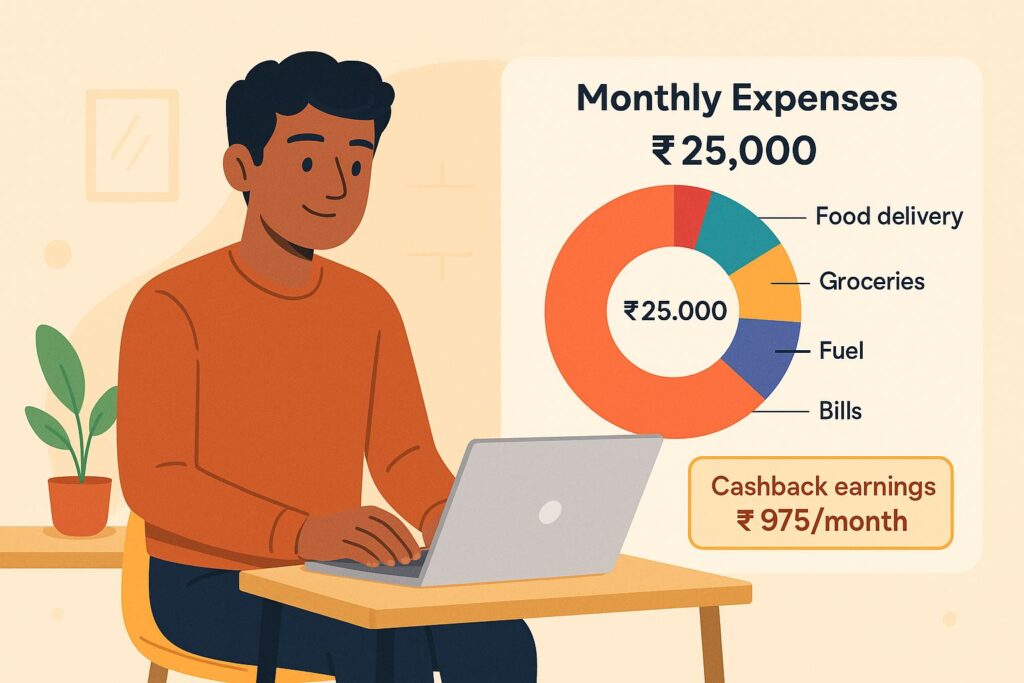

Meet Arjun, a 26-year-old marketing professional from Mumbai. Like most of us, he spends around ₹25,000 monthly on essentials—groceries, food delivery, petrol, bills and weekend outings. Until last year, every rupee went out with nothing coming back. Then he discovered UPI cashback stacking and now earns ₹12,000+ annually just by optimizing his payment methods. Here’s exactly how he did it and how you can too.

What is UPI Cashback Stacking? The Strategy Explained

UPI cashback stacking is the art of layering multiple cashback sources for every transaction. Instead of using one app you strategically combine different UPI apps like RuPay credit cards and reward programs to maximise returns on money you’re already spending.

The core principle: Use the right payment method for the right transaction to squeeze maximum value from every rupee spent.

The Complete UPI Cashback Stack: Your Arsenal

Layer 1: Primary Cashback Apps

1. Super.money by Flipkart

What it offers: Up to 5% guaranteed cashback on merchant transactions.

Key Features:

- No scratch cards or gimmicks – direct cashback to bank account.

- Assured cashback on every merchant payment.

- 3X faster payments with auto-scan mode.

- Partners: Flipkart, Amazon, Swiggy, Zomato, BookMyShow, Ola, Uber.

Eligibility: Open to all, currently in beta (100K users)

Best for: Online payments and frequent food delivery orders

2. BHIM UPI (Government App)

What it offers: Daily assured cashback + exclusive government offers

Key Features:

- Minimum ₹3 daily cashback on transactions

- ₹50 instant cashback on electricity bills above ₹500 (monthly)

- No convenience fees on bill payments

- Flat discounts on Swiggy, BigBasket

Eligibility: All Indian citizens with valid mobile number

Best for: Bill payments and government services

3. Kiwi App (RuPay Credit Focus)

What it offers: 1-5% cashback on UPI credit transactions.

Key Features:

- Lifetime free RuPay credit card

- ₹100 welcome cashback

- 2% on scan & pay transactions

- 5% cashback after ₹1.5L annual spend (Neon subscription)

Eligibility: CIBIL 750+, Age 21-60, No existing Kiwi/Yes Bank card

Best for: High-volume UPI spenders with credit needs

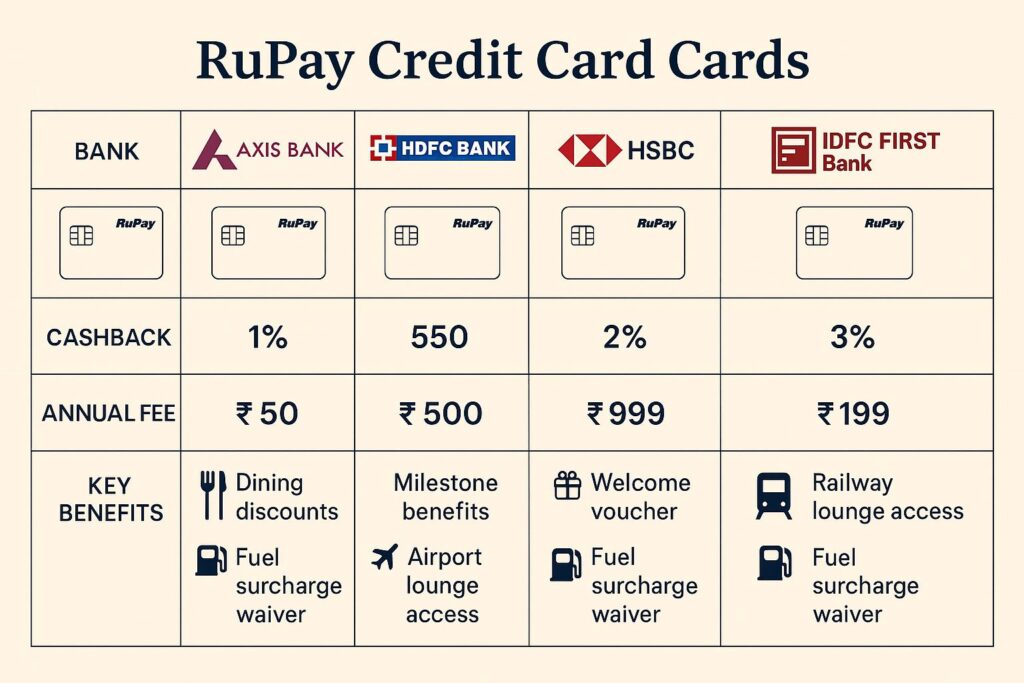

Layer 2: RuPay Credit Cards on UPI

Top RuPay Credit Cards for UPI Cashback

| Bank & Card | UPI Cashback Rate | Annual Fee | Key Benefits |

|---|---|---|---|

| Axis SuperMoney RuPay | 3% via SuperMoney app | ₀ (Lifetime Free) | 1% on all spends, fuel waiver |

| HDFC UPI RuPay | Variable offers | ₹500 | Exclusive cashpoints on groceries |

| HSBC RuPay Cashback | 10% dining/grocery | ₹499 | 0% forex markup |

| IDFC Digital RuPay | 3X points on UPI | ₀ (Lifetime Free) | Completely digital |

| Jupiter RuPay | 5% on Jupiter app | ₀ (Lifetime Free) | Banking + rewards combo |

Supported UPI Apps: PhonePe, GPay, Paytm, BHIM, Kiwi, Amazon Pay and 15+ other

Transaction Limit: ₹1 lakh/day (₹2 lakh for select merchants)

Layer 3: Strategic App Selection

Category-Wise Optimization

| Transaction Type | Best App Choice | Expected Cashback |

|---|---|---|

| Food Delivery | Super.money | 2-5% |

| Electricity Bills | BHIM UPI | ₹50/month flat |

| Groceries | HSBC RuPay via any UPI | 10% |

| Fuel Payments | Axis SuperMoney | 3% + fuel waiver |

| P2P Transfers | BHIM (for daily ₹3) | ₹3/day |

| Online Shopping | Kiwi RuPay | 2-5% |

Step-by-Step Implementation Guide

Phase 1: Setup (Week 1)

Step 1: Download and Setup Primary Apps

- Super.money:

- Download from Play Store (currently invitation-only beta)

- Link your primary bank account

- Complete KYC verification

- Pro tip: Join waitlist if beta is full

- BHIM UPI:

- Download official BHIM app

- Register with bank-linked mobile number

- Set UPI PIN

- Immediate benefit: Start earning ₹3 daily cashback

- Kiwi (if eligible):

- Check eligibility (CIBIL 750+)

- Apply for virtual RuPay credit card

- Link to UPI apps

- Welcome bonus: ₹100 cashback

Step 2: Apply for RuPay Credit Cards

Priority Order:

- Axis SuperMoney RuPay (if you use Super.money frequently)

- IDFC Digital RuPay (completely digital, instant approval)

- HSBC RuPay (if you spend heavily on dining/groceries)

Application Requirements:

- Age: 21-60 years

- Income: ₹25,000+/month (salaried) or ₹3L+/year (self-employed)

- CIBIL: 650+ (750+ for premium cards)

- Documents: PAN, Aadhaar, income proof, bank statements

Phase 2: Optimization (Week 2-4)

Step 3: Create Payment Rules

Arjun’s Winning Strategy:

- Morning coffee: BHIM (₹3 daily cashback)

- Lunch delivery: Super.money (5% cashback)

- Grocery shopping: HSBC RuPay via GPay (10% cashback)

- Fuel: Axis SuperMoney via PhonePe (3% + fuel waiver)

- Electricity bill: BHIM (₹50 monthly cashback)

- Weekend dining: Kiwi RuPay (2-5% cashback)

Step 4: Install Multiple UPI Apps

Essential Apps for Maximum Coverage:

- GPay: For HSBC RuPay rewards

- PhonePe: For Axis SuperMoney benefits

- Paytm: Backup for merchant acceptance

- BHIM: Daily cashback and government offers

Phase 3: Advanced Stacking (Month 2+)

Step 5: Milestone-Based Optimization

Monthly Spending Brackets:

₹10,000-20,000/month:

- Focus on BHIM + Super.money combo

- Expected earnings: ₹400-800/month

₹20,000-40,000/month:

- Add RuPay credit cards

- Expected earnings: ₹800-1,500/month

₹40,000+/month:

- Full stack with Kiwi Neon subscription

- Expected earnings: ₹1,500-2,500/month

Real-World Case Study: Arjun’s Monthly Breakdown

Arjun’s Spending Pattern

- Food delivery: ₹6,000 (Swiggy, Zomato)

- Groceries: ₹4,000 (BigBasket, Blinkit, Instamart, local stores)

- Fuel: ₹3,000 (petrol, CNG)

- Bills: ₹2,500 (electricity, mobile, DTH)

- Dining out: ₹4,000 (restaurants, cafes)

- Shopping: ₹3,500 (Amazon, Flipkart, local)

- Miscellaneous: ₹2,000 (pharmacy, services)

- Total: ₹25,000/month

Arjun’s Optimized Setup

- Super.money for food delivery: ₹6,000 × 5% = ₹300

- HSBC RuPay for groceries: ₹4,000 × 10% = ₹400 (capped)

- Axis SuperMoney for fuel: ₹3,000 × 3% = ₹90

- BHIM for bills: ₹2,500 + ₹50 flat = ₹50+

- Kiwi RuPay for dining: ₹4,000 × 2% = ₹80

- Regular UPI for rest: ₹5,500 × 1% = ₹55

Monthly Cashback Earned: ₹975

Annual Cashback: ₹11,700

Additional Benefits: Fuel waivers (₹400), welcome bonuses (₹350)

Total Annual Value: ₹12,450

Do’s and Don’ts: Maximizing Your Cashback

✅ Essential Do’s

1. Diversify Your Payment Methods

- Never rely on single app for all transactions

- Match highest cashback app to spending category

- Keep backup apps for merchant acceptance issues

2. Monitor Spending Caps

- Most cards have monthly cashback limits (₹200-500)

- Plan high-value transactions early in the month

- Track spending across different categories

3. Leverage Welcome Bonuses

- Time your card applications strategically

- Meet minimum spending requirements

- Refer friends for additional bonuses

4. Optimize Bill Payments

- Use BHIM for electricity (guaranteed ₹50/month)

- Avoid convenience fees with government app

- Time payments to qualify for monthly offers

5. Stay Updated on Offers

- Follow official social media accounts

- Enable push notifications for limited-time deals

- Join Telegram/WhatsApp groups for deal alerts

❌ Critical Don’ts

1. Don’t Overspend for Cashback

- Cashback is bonus, not reason to spend more

- Avoid impulse purchases for reward thresholds

- Credit card interest (3-4%/month) kills cashback benefits

2. Don’t Ignore Terms & Conditions

- Some categories excluded (rent, education, fuel on certain cards)

- Minimum transaction amounts may apply

- Cashback caps reset monthly, not daily

3. Don’t Put All Eggs in One Basket

- Apps can change policies or shut down

- Maintain accounts with multiple providers

- Don’t store large amounts in wallet apps

4. Don’t Compromise Security

- Never share UPI PINs or OTPs

- Use only official app store downloads

- Enable transaction notifications immediately

5. Don’t Miss Payment Deadlines

- Credit card late fees negate cashback benefits

- Set auto-payment for minimum amounts

- Track due dates religiously

Bank-Wise RuPay Credit Card Availability

Currently Live Banks (23 total):

Public Sector:

- State Bank of India (SBI Cards)

- Punjab National Bank

- Union Bank of India

- Indian Bank

- Canara Bank

- Indian Overseas Bank

Private Sector:

- HDFC Bank, ICICI Bank, Axis Bank

- Kotak Mahindra Bank, Yes Bank

- IDFC First Bank, IndusInd Bank

- Federal Bank, RBL Bank

Specialized Banks:

- AU Small Finance Bank

- Utkarsh Small Finance Bank

- ESAF Small Finance Bank

- SBM Bank, CSB Bank

- City Union Bank

Application Process:

- Online: Visit bank’s official website

- Branch: Visit nearest branch with documents

- Fintech Partners: Apply through Kiwi, Super.money apps

- Processing Time: 2-7 days for digital cards, 7-15 days for physical

Eligibility Variations by Bank:

- Income: ₹15,000-50,000/month depending on bank

- CIBIL: 650-750+ based on card tier

- Age: 18-65 years (varies by bank)

- Employment: Both salaried and self-employed accepted

Advanced Tips for Power Users

1. Credit Score Optimization

- RuPay credit cards help build credit history

- Keep utilization below 30% of credit limit

- Pay full amounts, not minimums

- Monitor CIBIL score monthly (free on Kiwi app)

2. Merchant Category Optimization

Different merchants coded differently affect rewards:

- Grocery stores: Often coded as supermarkets (higher rewards)

- Local kirana: May code as general retail (lower rewards)

- Online platforms: Usually code correctly for category bonuses

3. Tax Implications

- Cashback under ₹50,000/year generally not taxable

- Keep transaction records for high-value cashback

- Consult CA for amounts above ₹50,000 annually

4. Future-Proofing Your Strategy

- UPI Credit expanding rapidly – more banks joining monthly

- Cashback rates may reduce as market matures

- Build relationships with multiple fintech partners

Common Troubleshooting Issues

Problem: UPI transaction failures with RuPay credit cards

Solution:

- Ensure sufficient credit limit available

- Check if merchant accepts credit-on-UPI

- Try different UPI app (PhonePe vs GPay)

- Contact card issuer for merchant category restrictions

Problem: Cashback not credited automatically

Solution:

- Check transaction in app’s reward section

- Verify merchant was eligible for cashback

- Wait 24-48 hours for processing

- Contact app support with transaction details

Problem: Daily/monthly cashback limits reached

Solution:

- Switch to alternative apps for remainder of period

- Plan high-value transactions early in cycle

- Spread spending across multiple cards

The Future of UPI Cashback

Emerging Trends:

- Cryptocurrency integration: Some apps testing crypto cashback

- AI-powered optimization: Apps suggesting best payment methods

- Merchant-funded cashback: Stores directly funding rewards

- Cross-border UPI: International acceptance expanding

Regulatory Watch:

- RBI closely monitoring cashback sustainability

- Transaction limits may increase (currently ₹1L/day)

- More banks launching RuPay credit products

- Government push for digital adoption continues

Conclusion: Your Cashback Empire Awaits

UPI cashback stacking isn’t just about earning money—it’s about optimizing every financial decision you make daily. By following Arjun’s systematic approach you can realistically earn ₹8,000-15,000 annually without changing your spending habits.

The key principles:

- Start small with BHIM and Super.money

- Add RuPay credit cards strategically based on your spending

- Optimize category-wise for maximum returns

- Stay disciplined about payment deadlines and spending limits

- Keep learning as the ecosystem evolves rapidly

Remember, the best cashback strategy is one you can maintain consistently. Don’t try to implement everything at once—build your system gradually and let compound benefits work in your favor.

Your action plan for this week:

- Download BHIM UPI and start earning ₹3 daily

- Join Super.money waitlist if available

- Check your CIBIL score for RuPay card eligibility

- Calculate your monthly spending by category

- Choose one RuPay credit card to apply for

The UPI revolution has made earning money on daily expenses not just possible, but simple. All that’s left is for you to start stacking those cashbacks—one transaction at a time.

- Sunita Williams’ Secret: Astronaut Mindset That Builds Crores via SIP InvestingDiscover Sunita Williams’ astronaut mindset for wealth building: Solve crises “one bite at a time” like mutual fund SIP investing. Learn disciplined saving, risk pivots, and best mutual funds India strategies from her 27-year NASA career.

- The ₹1 Magic: Transform Pocket Change Into ₹1,378 With This Simple 52-Week PlanTransform your finances with India’s most popular 52-week money challenge. Save just ₹1 in week one, building to ₹52 by year-end for a total of ₹1,378. Discover the reverse challenge, practical tips, and how consistent saving habits create lasting financial freedom.

- Forget 10% Salaries: Why 48% of India’s Gen Z are Starting SIPs with Just ₹500Discover how India’s Gen Z is building wealth with just ₹500 monthly SIPs. From ₹3 trillion in SIP inflows to 100 million active accounts, young investors are leveraging compound interest and disciplined investing to achieve financial independence without hefty salaries or trust funds.

- Is Your Credit Card Quietly Killing Your Score? The 30% Factor Lenders Watch CloselyCredit utilization ratio can quietly make or break your CIBIL score. Keeping card usage below 30% signals control, not desperation. With simple moves—mid‑cycle payments, spreading spends, and requesting higher limits—you can boost approval odds and pay less interest overall today.

- Need a Loan? Use These 7 No-Gimmick Tactics to Fix Your CIBIL Score in Just 30 DaysBoost your CIBIL score by 50+ points in just 30 days with proven tactics. Master payment history, reduce credit utilization, and dispute errors to unlock better loan approvals and lower interest rates. No gimmicks—just real strategies that work.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for your kind words! Please reach me at avpatra09@gmail.com.

Pingback: How Digital Banking is Changing India’s Financial Landscape

Pingback: UPI Limit Increase 2025: ₹10 Lakh Daily Payment Cap

Pingback: UPI 3.0: Revolutionizing Digital Payments in India 2025

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://bankermoney.com

Pingback: UPI Transaction History: Track Spending & Build Wealth