Last Tuesday, my neighborhood grocery store owner in Narnaund frantically asked if he should stop accepting ₹500 notes. WhatsApp forwards had convinced him that these notes would become worthless by March. Within hours, I heard similar panicked questions at the local tea stall, from my auto driver, and even from my aunt who lives in Chandigarh. If you’re reading this, chances are someone forwarded you that same message claiming the Reserve Bank of India is pulling the plug on our beloved pink-grey notes.

Let’s cut through the noise and get to the truth.

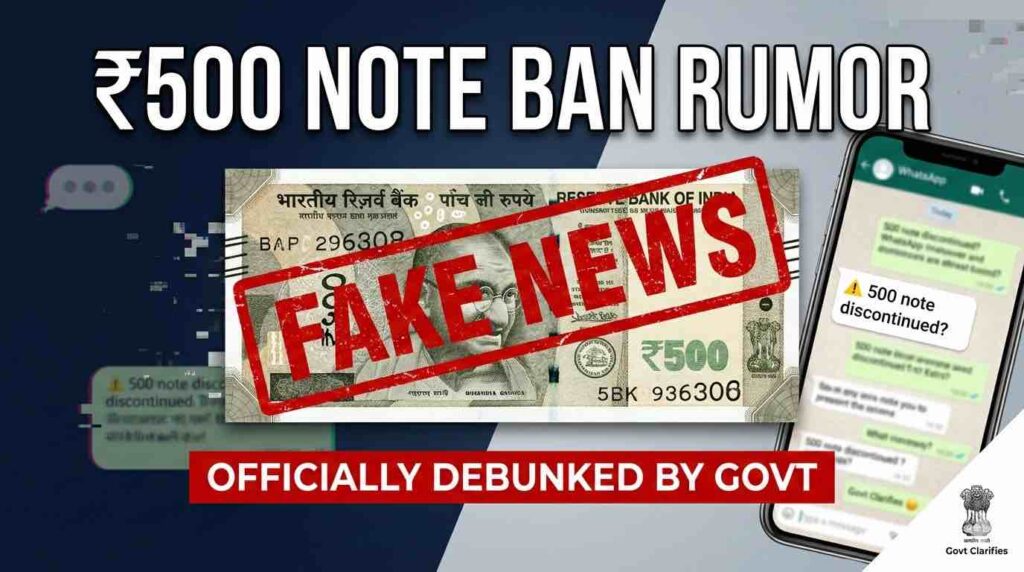

The Viral Claim That Triggered Nationwide Panic

The rumor mill went into overdrive when a YouTube channel called “Capital TV” posted a video claiming that ₹500 notes would be discontinued by March 2026. The video, which racked up over five lakh views before being debunked, made some alarming claims that spread faster than wildfire across WhatsApp groups and Facebook feeds.

According to the viral message, the RBI had supposedly instructed all banks to gradually stop dispensing ₹500 notes from ATMs—75% of machines by September 30, 2025, and a whopping 90% by March 31, 2026. The message urged people to “start liquidating” their ₹500 notes immediately, warning that ATMs would soon dispense only ₹100 and ₹200 notes.

Sound familiar? It should. Because this exact pattern of misinformation has been haunting Indian social media for months.

Government’s Swift Response: Debunking the Fake News

The Press Information Bureau’s Fact Check unit wasted no time in calling out this fabrication. On January 2, 2026, PIB posted on X (formerly Twitter): “Has RBI really asked banks to stop disbursing ₹500 notes from ATMs by September 2025? A message falsely claiming exactly this is spreading on WhatsApp. PIB Fact Check: No such instruction has been issued by the RBI. ₹500 notes will continue to be legal tender.”

This wasn’t the first time the government had to step in. Back in June 2025, the same rumor surfaced, and PIB had to issue an identical clarification. Then again in July 2025, when a viral WhatsApp forward claimed ATM withdrawal limits on ₹500 notes, the fact-check team labeled it “completely untrue.”

Finance Minister of State Pankaj Chaudhary even addressed the issue in Parliament’s Rajya Sabha in August 2025, stating unequivocally that the government has no proposal to stop the supply of ₹500 notes and that ATMs would continue dispensing them alongside ₹100 and ₹200 denominations.

Why This Rumor Felt So Believable

Here’s where things get interesting. The rumor didn’t appear out of thin air—it cleverly twisted a real RBI circular to create fake news.

In April 2025, the RBI did issue genuine instructions to banks and White Label ATM Operators. But the actual directive was about increasing the availability of smaller denomination notes, not eliminating ₹500 notes. The central bank asked banks to ensure that by September 30, 2025, at least 75% of ATMs would dispense either ₹100 or ₹200 notes from at least one cassette, with this coverage reaching 90% by March 31, 2026.

The goal? Simple and sensible. The RBI wanted to address public complaints about the shortage of “chhuta paisa” (small change). Data showed that ₹500 notes now comprise 86.5% of currency value in circulation, making everyday transactions difficult when shopkeepers can’t provide change.

But rumor mongers cleverly reframed this legitimate policy as a “ban” on ₹500 notes, exploiting people’s memories of 2016.

The Ghost of Demonetization Past

November 8, 2016, is seared into every Indian’s memory. When Prime Minister Narendra Modi announced the demonetization of old ₹500 and ₹1,000 notes, the move represented 85% of cash in circulation. Long queues at banks, cash shortages, and economic disruption followed. The government introduced new ₹500 notes and ₹2,000 notes to replace them.

That experience created a psychological vulnerability. Any whiff of similar news triggers immediate anxiety. Rumor spreaders know this and deliberately craft their fake news to mimic the language and patterns of 2016 announcements.

The ₹2,000 notes were withdrawn from circulation in May 2023 (though they remain legal tender), which only added fuel to the fire. People connected the dots incorrectly, assuming ₹500 notes would be next.

The Real Status: ₹500 Notes Are Here to Stay

Let’s be crystal clear: ₹500 notes have NOT been discontinued and remain legal tender. The RBI continues to print and distribute them. Banks accept them without question. You can deposit them, withdraw them, and use them for any transaction across India.

The note, featuring the Red Fort in stone grey color, continues to be the backbone of India’s cash economy. Its size (66mm x 150mm) and security features remain unchanged, and the amount is still written in 17 languages, from Assamese to Urdu.

What about those ATM changes? The RBI’s focus on smaller denominations is actually good news for consumers. It means when you withdraw ₹1,000, you might get five ₹200 notes instead of two ₹500 notes, making it easier to spend at local shops. The ₹500 notes aren’t disappearing—they’re simply being supplemented, not replaced.

How to Spot Fake Currency News

This incident teaches us valuable lessons about verifying financial information. Here’s what you should do next time you see such claims:

Check the source: Is it from PIB, RBI, or a verified news outlet? Random YouTube channels and WhatsApp forwards are not credible sources.

Look for official statements: The RBI publishes all significant notifications on its official website (rbi.org.in). If you can’t find it there, it’s fake.

Cross-verify: Don’t rely on one forward. Check multiple established news websites like The Economic Times, NDTV, or BBC.

Use PIB Fact Check: The government runs an active fact-checking unit on X (@PIBFactCheck) that regularly debunks misinformation.

Be skeptical of urgency: Real policy changes come with adequate notice, not panic-inducing deadlines. The government learned from 2016 that sudden moves cause chaos.

The Bigger Picture: Why These Rumors Keep Spreading

This isn’t just about ₹500 notes. India faces a systematic problem of financial misinformation. Similar rumors have circulated about:

- New rules for exchanging old ₹500/₹1,000 notes (false)

- Chips in ₹2,000 notes tracking your location (conspiracy theory)

- Radioactive ink in new currency (baseless)

The pattern is clear: someone creates sensational content for views and engagement, exploiting people’s financial anxieties. Social media algorithms amplify it because outrage and fear generate clicks. By the time official denials come, the damage is done.

What Should You Do Now?

Nothing. Absolutely nothing. Your ₹500 notes are safe. Continue using them normally. If someone forwards you the rumor, share this article or the PIB Fact Check link instead of spreading panic.

The next time you hear about any currency discontinuation, take a deep breath and remember: the Government of India and RBI always announce such major decisions through official channels first, not through shady YouTube videos.

Final Thoughts

The ₹500 note discontinuation rumor reveals how quickly misinformation can spread in our hyper-connected world. It took one misleading video to create nationwide anxiety, forcing the government to intervene repeatedly. While the rumor has been thoroughly debunked, it serves as a reminder to verify before we forward.

Our ₹500 notes remain legal tender, widely accepted, and essential to India’s economy. The only thing that needs discontinuing is our habit of believing everything we see on social media.

So go ahead, use that ₹500 note in your wallet without worry. The only thing you should be questioning is the source of your news, not the validity of your currency.

- HDFC Bank Q3 Surprise: Profit Jumps 11.5% – Why Experts Call It a ‘Screaming Buy’ at ₹930HDFC Bank’s Q3 FY26 results shine: 11.5% profit surge to ₹18,653 Cr, GNPA at 1.24%, deposits up 11.5%. Beats estimates amid deposit wars—strong buy for 2026? Stock eyes ₹1,000 breakout.

- Withdraw PF Money in Seconds? EPFO’s New UPI Update is the Game-ChangerDiscover EPFO UPI withdrawal: Instant PF access in minutes via PhonePe or Google Pay. Step-by-step guide, eligibility, benefits, and tax rules for 2026. Skip delays—empower your savings today!

- The Truth Behind the “TCS Employee Salary Drop”: Viral News, Variable Pay and What It Means for YouDiscover the real reasons behind the viral TCS employee salary drop. From variable pay cuts to strict WFO mandates and performance bands, learn why IT take-home pay is shrinking and how to protect your earnings effectively.

- Stop! Don’t “Liquidate” Your ₹500 Notes Yet: What the New RBI Circular Actually SaysGOI debunks viral ₹500 note discontinuation rumor. Fake news claimed RBI would ban notes by March 2026. Official clarification: ₹500 notes remain legal tender, ATMs continue dispensing them. Learn how to spot fake currency news and verify financial information.

- Cheques are Making a Huge Comeback in India—and They’re Now as Fast as UPI!India’s real-time cheque clearing system launched October 2025, processing cheques in hours instead of days. While Phase 2 was postponed, Phase 1 delivers same-day clearing with auto-approval features. Learn how continuous clearing speeds up banking for businesses and freelancers.

- Planning a Gold Loan in 2026? This New RBI Rule Could Slash Your Cash by Thousands OvernightApril 2026 brings RBI’s new gold loan regulations with tiered LTV limits: 85% for loans under ₹2.5 lakh, 80% for ₹2.5–5 lakh, and 75% above. Understand how these rules impact your borrowing capacity and protect your precious ornaments.

- Why Your Old Chequebook Might Stop Working: Understanding India’s Bold Bank ConsolidationExplore India’s ambitious PSU bank consolidation strategy reshaping the financial sector. Understand recent mergers, the government’s FY27 mega plan, and how bank consolidation impacts customers, employees, and the broader banking ecosystem.

- Big Relief for Businesses: RBI Relaxes Current Account Norms; Major Changes Effective April 2026The RBI’s December 2025 amendments fundamentally reshape business financing by removing restrictions on cash credit accounts and raising current account thresholds to Rs 10 crore. These relaxations in current and cash credit norms enhance working capital accessibility, enabling businesses to optimize liquidity management and reduce operational financing costs significantly.

- One Rule for All: How RBI’s Standardized Minimum Balance Will Change Your Banking in 2026The Reserve Bank of India’s updated minimum balance framework, effective December 10, 2025, reduces penalties to ₹200 maximum and introduces flexible thresholds. Urban savings accounts require ₹500 minimum, rural accounts ₹200, while zero balance BSBD accounts eliminate requirements entirely, promoting financial inclusion across India’s banking sector.

- No More Shortcuts: RBI Plugs Regulatory Gaps for NBFCs and HFCs in Landmark December AmendmentThe RBI’s December 2025 amendment extends regulatory oversight to Non-Banking Financial Companies and Housing Finance Companies within banking groups. This consolidated supervisory framework eliminates regulatory gaps, enforces harmonized prudential standards, and ensures comprehensive group-level risk management across India’s financial services sector.