The financial landscape for Indian banking is undergoing significant transformation. The Reserve Bank of India has introduced updated minimum balance requirements that take effect from December 10, 2025, marking one of the most substantial shifts in how banks manage customer deposits. Understanding these changes is crucial for anyone maintaining a savings account, as they directly influence your banking costs and account management strategy.

The Core Changes: What RBI’s New Minimum Balance Rule Means for You

Starting this December, the RBI’s new minimum balance framework fundamentally alters how penalties and account maintenance work across scheduled commercial banks. Rather than imposing a single universal threshold, the Reserve Bank of India is allowing financial institutions greater flexibility in setting tiered minimum balance requirements tailored to different account types and customer segments.

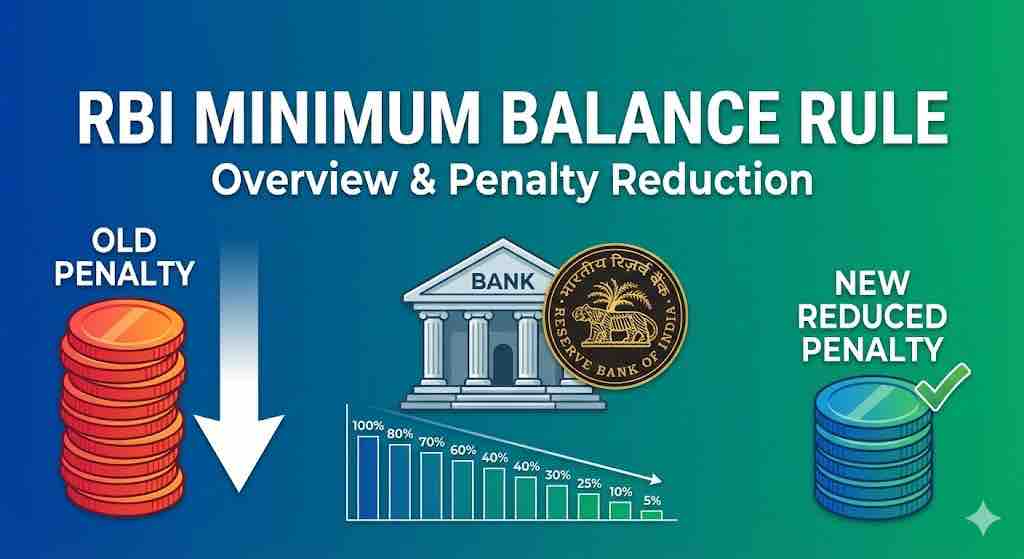

Under the previous system, banks could impose penalty charges up to ₹600 for customers failing to maintain their required balance. The new RBI banking guidelines dramatically reduce these penalties to a maximum of ₹200, representing a significant relief for account holders. For standard savings accounts in urban and metro branches, the minimum balance requirement now sits at ₹500, while rural accounts operate on an even lower threshold of ₹200.

This shift toward financial inclusion reflects the RBI’s broader commitment to making banking services accessible to smaller savers, students, and individuals with irregular income streams. The new rules ensure that maintaining a savings account no longer creates an insurmountable financial burden for millions of Indians.

Understanding the New Tiered Minimum Balance Structure

The minimum balance in savings accounts is no longer a one-size-fits-all proposition. Banks operating under the updated RBI savings account guidelines can establish different thresholds based on account categories and customer demographics. This tiered approach gives customers meaningful choices when selecting accounts that align with their financial capacity and banking habits.

For current accounts, the new framework establishes thresholds ranging from ₹12,000 to ₹30,000 depending on account tier and banking category. Meanwhile, current account penalty charges reach up to ₹1,000 monthly for non-compliance, underscoring the distinction between savings and business banking products.

The most transformative aspect involves zero balance accounts. Customers can now maintain BSBD (Basic Savings Bank Deposit) accounts with absolutely no minimum balance requirement whatsoever. These accounts come with expanded free services including an ATM or ATM-cum-debit card without annual charges, unlimited monthly cash deposits, four complimentary withdrawals each month, and comprehensive digital banking access through mobile and internet platforms.

How Bank Minimum Balance Requirements Vary by Institution

While the RBI provides the regulatory framework, individual banks retain significant autonomy in determining their specific minimum balance policies. This explains why you’ll notice substantial variations between different financial institutions:

ICICI Bank substantially increased its average monthly balance requirements in August 2025. For metro cities, the minimum balance for new savings account holders jumped from ₹10,000 to ₹50,000, a five-fold increase. Semi-urban locations saw their requirements rise to ₹25,000, while rural locations were set at ₹10,000.

In contrast, SBI minimum balance requirements remain comparatively modest at ₹1,000 for regular savings accounts, reflecting the public sector bank’s approach toward financial inclusion. PNB and Bank of Baroda similarly maintain lower thresholds, keeping savings account accessibility broader for general customers.

The Pradhan Mantri Jan Dhan Yojana (PMJDY) accounts and other government-backed banking products continue offering completely zero-balance operations with no minimum balance penalty considerations. This makes them excellent alternatives for customers unable to maintain conventional account minimums.

Penalty Charges Reduction: Breaking Down the New Fee Structure

One of the most customer-friendly aspects of the RBI’s updated regulations involves the dramatic reduction in penalty charges for low balance. Banks previously operated under a system where penalty structures could escalate disproportionately based on shortfall amounts. The new guidelines enforce proportional penalty assessment, meaning charges must correspond directly to how much your balance falls short of requirements.

The standard penalty now ranges between ₹50 to ₹200 per month, contingent on your bank’s specific policies and account classification. Importantly, banks are prohibited from creating negative account balances through these penalty charges. This protection ensures customers don’t end up owing money to their banks due to administrative fees.

Banks must also notify customers through SMS, email, or letter before applying any penalties. This notification requirement gives account holders a full month to restore their minimum balance before charges take effect. Such transparent communication represents a major improvement over previous banking practices where penalties could surprise customers unexpectedly.

Practical Strategies for Maintaining Your Minimum Balance

While the new RBI framework makes account maintenance easier, developing practical strategies still helps avoid unnecessary penalties and account service restrictions. The following approaches have proven effective for millions of Indian account holders:

Regular Account Monitoring: Establish a routine of checking your account balance through mobile banking applications, internet banking portals, or traditional SMS alerts. This habit keeps you informed about every transaction and prevents accidental balance breaches. Most banks now offer real-time notifications that instantly alert you to significant withdrawals or deposits.

Activate Balance Alert Systems: Nearly all banks provide customizable SMS and email notifications when your account balance approaches the minimum threshold. Enabling these alerts creates an early warning system that allows corrective action before penalties apply. Many customers find setting alerts at 10-15% above their minimum balance particularly effective.

Smart Bill Payment Automation: While automatic bill payments offer genuine convenience, they can unexpectedly reduce your balance below required levels. Schedule automated payments only after confirming sufficient funds availability, or consider linking them to a secondary account specifically designated for bill payments.

Maintain a Balance Cushion: Instead of keeping exactly your minimum balance requirement, maintain a small buffer above it. If your minimum requirement is ₹5,000, aim to keep approximately ₹6,000 available. This modest cushion protects against accidental dips caused by unforeseen expenses or delayed deposits.

Utilize Linked Accounts and Overdraft Facilities: Some banks offer overdraft facilities or allow linking multiple accounts together. These tools can automatically cover shortfalls in your savings account, effectively safeguarding you against minimum balance penalties while maintaining account functionality.

Account Type Selection: If maintaining a bank account minimum balance consistently proves difficult given your financial circumstances, honestly reassess whether your current account type suits your lifestyle. Switching to accounts with lower thresholds or zero balance requirements eliminates this stress entirely.

The Financial Inclusion Impact: Who Benefits Most from These Changes?

The RBI’s decision to modify minimum balance rules specifically targets financial inclusion objectives that have long driven the central bank’s policy decisions. Students, small business proprietors, agricultural workers, and individuals with irregular income streams face particular challenges maintaining high account minimums. The new RBI minimum balance framework directly addresses these accessibility barriers.

Young professionals entering the workforce often receive irregular starting salaries or need time to establish stable income. Previously, minimum balance requirements prevented many from accessing formal banking services. The reduced thresholds and lowered penalty structures now make savings accounts genuinely accessible to this demographic.

Women engaged in self-employment or micro-entrepreneurship similarly benefit from the increased flexibility. The new rules allow entrepreneurial women to maintain banking relationships essential for business growth without bearing disproportionate penalty burdens that discourage financial system participation.

Rural populations now enjoy reasonable minimum balance thresholds aligned with local income patterns and economic realities. The ₹200 minimum for rural branches represents genuine recognition that rural customers shouldn’t subsidize banking system participation through excessive balance requirements.

Zero Balance Account Benefits: A Comprehensive Alternative

For customers determined to eliminate minimum balance considerations entirely, BSBD accounts represent a transformative option. While traditionally perceived as stripped-down accounts offering minimal features, the updated RBI guidelines significantly expanded BSBD capabilities.

These accounts now offer cash deposits without limitation, fund receipts through electronic transfer channels, cheque deposits, and unlimited monthly deposits. Customers receive ATM or ATM-cum-debit cards without annual fees, comprehensive internet and mobile banking access, physical passbooks with monthly statements, and four free cash withdrawals monthly.

Digital transactions including UPI payments, NEFT, RTGS, and IMPS operate independently of withdrawal limits, meaning customers can conduct unlimited digital transfers and payments. This makes zero balance accounts genuinely sufficient for modern banking needs where digital transactions predominate.

Converting existing accounts to BSBD status requires just a written request and takes effect within seven days. Banks cannot charge conversion fees, and customers can reverse the decision anytime by requesting restoration to regular savings account status.

Average Monthly Balance (MAB) Versus Daily Balance: Understanding the Calculation

Banks increasingly prefer monthly average balance assessment rather than daily minimum balance requirements. This distinction meaningfully impacts account management strategies. Daily balance accounts demand maintaining minimum funds throughout every single day, creating continuous pressure on cash flow.

Average monthly balance calculations work differently. If your minimum balance requirement is ₹10,000 monthly average balance, your actual daily balance can fluctuate substantially, sometimes dipping considerably below that threshold. What matters is that your total balance across all days, divided by the number of days, equals at least ₹10,000.

This distinction proves practically valuable. You might receive salary deposits early in the month, maintain higher balances initially, then make significant withdrawals or payments later in the same month. As long as the mathematical average across all days meets requirements, you avoid penalties. This flexibility reduces the psychological burden of constant balance monitoring while accommodating genuine life circumstances.

Implementation Timeline and Bank-Specific Considerations

Different banks are implementing the RBI’s updated framework at varying speeds, though December 10, 2025 represents the formal effective date. Customers should verify their specific bank’s timeline through official circulars, website announcements, or direct branch communication. Some institutions completed implementation in early December, while others extended transition periods allowing existing customers to adjust.

Your bank’s tariff schedule contains the definitive information about your specific minimum balance requirement, applicable penalty structure, and any transition provisions for existing accounts. These schedules must be transparent and disclosed at account opening and before any changes take effect.

Addressing Common Questions About the New RBI Framework

What happens if I cannot maintain the minimum balance during temporary financial difficulties?

Contact your bank immediately. Many institutions work with customers experiencing temporary hardship, potentially waiving penalties or temporarily adjusting requirements. Banks increasingly recognize that financial difficulties happen to regular customers, and modern banking values customer retention over rigid enforcement.

Can I link multiple accounts to maintain a combined minimum balance?

Some banks allow this through specific account linkage facilities, though policies vary significantly. Discuss this possibility with your relationship manager if maintaining a single account’s minimum proves genuinely difficult.

Do BSBD accounts earn interest?

Yes, updated regulations mandate that zero balance accounts earn minimum 3.5% annual interest, effective January 1, 2025. This eliminates the previous penalty of earning nearly no interest while maintaining zero balance accounts.

What occurs if I fall below the minimum balance for just one day?

For monthly average balance accounts, one day’s shortfall is absorbed into your monthly calculation. For daily balance accounts, penalties apply only if the requirement remains unmet after the 30-day notice period provided by banks.

Moving Forward: Adapting to the New Minimum Balance Landscape

The RBI’s updated minimum balance framework represents genuine progress toward inclusive banking. These changes reflect recognition that financial services should remain accessible regardless of income level or economic stability. The reduced penalties, flexible thresholds, and expanded zero balance options create meaningful choices for every customer segment.

Your response should involve reviewing your current account’s minimum balance requirement and penalty structure against your actual financial capacity. If your existing account imposes burdens that don’t match your lifestyle, explore alternatives. Whether switching account types, changing institutions, or converting to zero balance options, you now have genuine flexibility previously unavailable.

The financial discipline that minimum balance requirements encourage remains valuable. However, these requirements should facilitate banking participation rather than obstruct it. The RBI’s new framework finally achieves this balance, making formal banking genuinely accessible to India’s entire population while maintaining the beneficial habits that responsible account management requires.

- HDFC Bank Q3 Surprise: Profit Jumps 11.5% – Why Experts Call It a ‘Screaming Buy’ at ₹930HDFC Bank’s Q3 FY26 results shine: 11.5% profit surge to ₹18,653 Cr, GNPA at 1.24%, deposits up 11.5%. Beats estimates amid deposit wars—strong buy for 2026? Stock eyes ₹1,000 breakout.

- Withdraw PF Money in Seconds? EPFO’s New UPI Update is the Game-ChangerDiscover EPFO UPI withdrawal: Instant PF access in minutes via PhonePe or Google Pay. Step-by-step guide, eligibility, benefits, and tax rules for 2026. Skip delays—empower your savings today!

- The Truth Behind the “TCS Employee Salary Drop”: Viral News, Variable Pay and What It Means for YouDiscover the real reasons behind the viral TCS employee salary drop. From variable pay cuts to strict WFO mandates and performance bands, learn why IT take-home pay is shrinking and how to protect your earnings effectively.

- Stop! Don’t “Liquidate” Your ₹500 Notes Yet: What the New RBI Circular Actually SaysGOI debunks viral ₹500 note discontinuation rumor. Fake news claimed RBI would ban notes by March 2026. Official clarification: ₹500 notes remain legal tender, ATMs continue dispensing them. Learn how to spot fake currency news and verify financial information.

- Cheques are Making a Huge Comeback in India—and They’re Now as Fast as UPI!India’s real-time cheque clearing system launched October 2025, processing cheques in hours instead of days. While Phase 2 was postponed, Phase 1 delivers same-day clearing with auto-approval features. Learn how continuous clearing speeds up banking for businesses and freelancers.

- Planning a Gold Loan in 2026? This New RBI Rule Could Slash Your Cash by Thousands OvernightApril 2026 brings RBI’s new gold loan regulations with tiered LTV limits: 85% for loans under ₹2.5 lakh, 80% for ₹2.5–5 lakh, and 75% above. Understand how these rules impact your borrowing capacity and protect your precious ornaments.

- Stop Paying Your Bank! RBI’s New Zero-Balance Rules Could Save You Over ₹5,000 Every YearYour bank account shouldn’t drain your pocket. Millions of Indians lose ₹5,000+ yearly to hidden charges and penalties. The RBI’s revised zero-balance account rules—effective April 2026—eliminate these fees entirely. Discover how to save thousands while maintaining complete banking access.

- Why Your Old Chequebook Might Stop Working: Understanding India’s Bold Bank ConsolidationExplore India’s ambitious PSU bank consolidation strategy reshaping the financial sector. Understand recent mergers, the government’s FY27 mega plan, and how bank consolidation impacts customers, employees, and the broader banking ecosystem.

- Big Relief for Businesses: RBI Relaxes Current Account Norms; Major Changes Effective April 2026The RBI’s December 2025 amendments fundamentally reshape business financing by removing restrictions on cash credit accounts and raising current account thresholds to Rs 10 crore. These relaxations in current and cash credit norms enhance working capital accessibility, enabling businesses to optimize liquidity management and reduce operational financing costs significantly.

- One Rule for All: How RBI’s Standardized Minimum Balance Will Change Your Banking in 2026The Reserve Bank of India’s updated minimum balance framework, effective December 10, 2025, reduces penalties to ₹200 maximum and introduces flexible thresholds. Urban savings accounts require ₹500 minimum, rural accounts ₹200, while zero balance BSBD accounts eliminate requirements entirely, promoting financial inclusion across India’s banking sector.

Pingback: Save ₹5,000+ Annually With RBI Zero-Balance Account Rules

Pingback: ₹500 Note Ban Rumor Debunked: GOI Clarifies Currency Status

Pingback: Cheques Are Back & Faster: Real-Time Clearing System 2026