Your bank account shouldn’t drain your pocket before you even start saving. Yet millions of Indians lose thousands every year to hidden charges, minimum balance penalties, and fees they didn’t even know existed. The Reserve Bank of India’s latest regulatory changes for zero-balance accounts are about to change that equation dramatically.

From April 1, 2026, the RBI’s revised Basic Savings Bank Deposit Account (BSBD) guidelines will reshape how banks operate zero-balance accounts. These aren’t minor tweaks—they represent a fundamental shift toward genuine financial inclusion. If you’ve been hesitant about switching to a zero-balance savings account, this is your moment to understand exactly how much money you could be saving.

The Hidden Cost of Regular Savings Accounts

Before diving into the benefits, let’s talk about what you’re currently paying for the privilege of maintaining a traditional savings account. Most people don’t realize the true cost of a regular savings account because banks disguise these expenses in different ways.

If you fail to maintain your bank’s minimum balance requirement—which ranges from ₹2,500 to ₹50,000 depending on your bank and location—you face monthly penalties. These aren’t small fees either. ICICI Bank charges 6% of the shortfall with a ₹500 cap. Kotak Mahindra Bank levies a 6% penalty capped at ₹500. Even after the RBI’s crackdown, these fees accumulate quickly. Over a year, if you dip below the required balance just five times, you could lose ₹1,500 to ₹3,000 in penalties alone.

Then there are ATM withdrawal charges. Since May 2025, every ATM withdrawal beyond your free limit costs ₹23. If you make just one extra withdrawal per week beyond your quota, that’s roughly ₹1,200 annually. Add debit card annual fees (₹150-₹500), cheque book charges, and SMS alert fees, and you’re looking at another ₹1,500-₹2,000 per year.

The bottom line? Most people are unknowingly paying ₹5,000 to ₹7,000 annually just to maintain a regular savings account. This is precisely what zero-balance accounts eliminate.

What’s Changing with RBI’s 2026 Rules

The RBI’s Amendment Directions issued on December 4, 2025, represent the most comprehensive overhaul of zero-balance account regulations since their introduction. These rules come into force on April 1, 2026, and they fundamentally protect consumers from indirect coercion to maintain unnecessary balances.

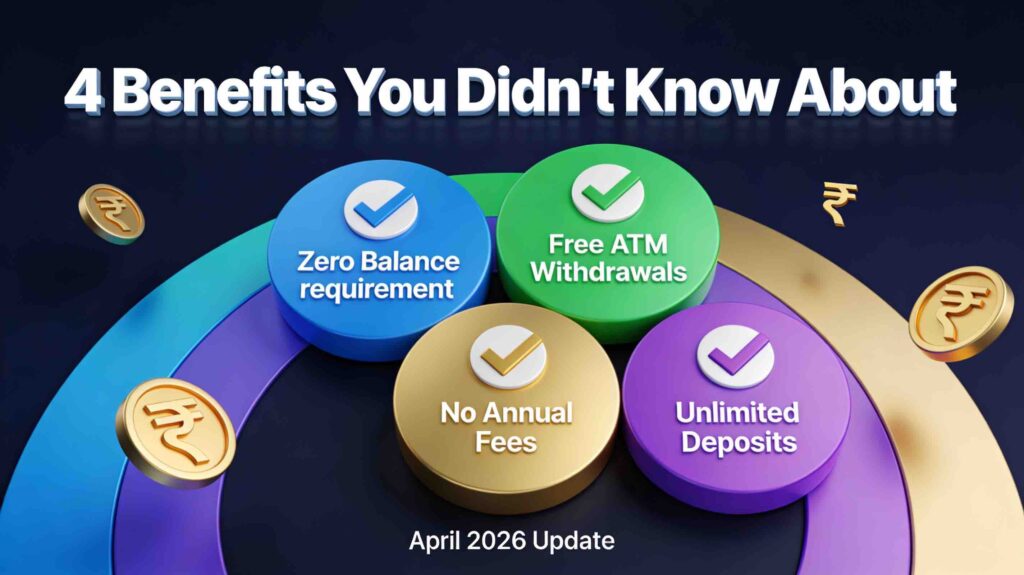

Here’s what you get with the new zero-balance savings account standards:

Genuinely Zero Minimum Balance Requirement

No more ambiguous fine print. Banks cannot require you to maintain a minimum balance—period. This applies across all banking categories: commercial banks, small finance banks, payments banks, local area banks, and regional rural banks. The RBI has been explicit: banks cannot impose any initial deposit either. You can open a genuine zero-balance account and keep it at zero.

Enhanced Free Banking Services

Every zero-balance savings account must now offer a complete suite of free basic facilities:

Unlimited deposits through any channel—cash deposits at branches, electronic transfers, mobile banking, UPI, all completely free. There’s no cap on the number or value of deposits you can make monthly.

Free ATM and debit card with zero annual charges. The card is issued at no cost and requires no renewal fees. This alone saves you ₹150-₹500 annually compared to regular accounts.

Complimentary cheque book with a minimum of 25 leaves per year, issued free and renewed without charges. For customers who still prefer physical cheques, this eliminates ₹50-₹100 in annual costs.

Internet and mobile banking completely free, giving you 24/7 access to your account from anywhere.

Four guaranteed free withdrawals per month, including ATM withdrawals, transfers, and mobile money transactions. This is critical: digital payments like UPI, NEFT, RTGS, and IMPS don’t count toward this limit, meaning your digital transactions remain completely free and unlimited.

Passbook or monthly statements provided free in print or electronically, eliminating ₹20-₹30 annual fees from other banks.

Non-Discretionary Service Provision

The RBI has also clarified that banks cannot force you to adopt ATM cards, cheque books, or digital banking services you don’t want. These are available only upon request. This might seem minor, but it prevents banks from bundling expensive services with your zero-balance account.

How This Translates to ₹5,000+ Annual Savings

Let’s do the math on actual, tangible savings using realistic scenarios:

Scenario 1: The Casual User

- Minimum balance penalties avoided: ₹300-₹500/month × 12 = ₹3,600-₹6,000/year

- Debit card annual fee saved: ₹200

- Cheque book charges avoided: ₹60

- Total annual savings: ₹3,860-₹6,260

Scenario 2: The Frequent Withdrawal User

- ATM withdrawal charges avoided (6 extra withdrawals monthly at ₹23 each): ₹1,656/year

- Minimum balance penalties: ₹3,600/year

- Debit card fees: ₹200

- Mobile banking charges: ₹60

- Total annual savings: ₹5,516/year

Scenario 3: The Low-Balance Maintainer

- Consistent shortfall penalties (₹200/month): ₹2,400/year

- Annual debit card fee: ₹300

- ATM charges (4 extra withdrawals/month): ₹1,104/year

- Passbook/statement fees: ₹50

- Total annual savings: ₹3,854/year

Even conservative estimates show savings exceeding ₹3,800 annually. For those with frequently fluctuating balances or higher transaction frequency, the savings easily cross ₹6,000 per year.

The Complete Feature Comparison

| Feature | Regular Savings Account | New Zero-Balance Account |

|---|---|---|

| Minimum Balance Required | ₹2,500-₹50,000 | ₹0 |

| Monthly Balance Penalty | ₹100-₹600 | ₹0 |

| Debit Card Annual Fee | ₹150-₹500 | Free |

| ATM Withdrawals (Free Limit) | 3-5/month | 4/month |

| ATM Charges Beyond Limit | ₹23/transaction | ₹23/transaction |

| Cheque Book Cost | ₹50-₹150 | Free |

| Internet Banking | Sometimes charged | Free |

| Mobile Banking | Sometimes charged | Free |

| Unlimited Digital Payments | Some banks charge | Completely Free |

| Monthly Cost Range | ₹200-₹600 | ₹0 |

Which Bank Should You Choose?

The RBI’s 2026 rules apply universally, but banks differ in their additional offerings beyond minimum requirements. Here’s what top zero-balance savings accounts are offering:

SBI Basic Savings Bank Deposit Account offers 2.70% interest with no charges. It’s the most straightforward option, especially for government employees and pensioners who value simplicity and reliability.

Kotak 811 Digital Account provides up to 4.00-5.75% interest with ActivMoney, which automatically sweeps idle funds into fixed deposits. It’s perfect for tech-savvy users wanting to maximize returns on their balance.

IDFC FIRST Bank Digital Savings Account delivers up to 7.25% interest with zero fees on all digital transfers. This is excellent if you’re looking for the highest interest rate combined with complete fee elimination.

IndusInd Bank Indie Account offers 6.75% interest plus a rewards program that earns you 3% cashback on three chosen brands. It’s ideal if you want to combine savings with shopping benefits.

Federal Bank FedSelfie Account can be opened in five minutes using only your Aadhaar and PAN through the mobile app. It’s the fastest option for first-time account openers.

Important Clarifications About the New Rules

The RBI has been specific about preventing loopholes. Banks cannot indirectly pressure you to maintain balances through service restrictions or hidden conditions. If a bank offers additional services beyond the basic package, it cannot tie these to minimum balance requirements.

Existing zero-balance account holders will have access to the new free services upon request. Banks must respond to these requests within a reasonable timeframe through both physical and digital channels.

One crucial limitation: you can only hold one zero-balance account across all banks. Before opening a new account, you’ll need to declare that you don’t already have one. This prevents misuse and keeps the system robust.

The Real-World Impact

These changes particularly benefit three groups of account holders who typically lose the most money to banking charges.

Students and first-time workers often maintain low balances because of irregular income. They’ve historically been penalized the most for this normal life situation. The new rules eliminate that entirely.

Gig economy workers and freelancers with highly variable monthly income can now maintain accounts without fear of penalty when lean months happen. This reduces financial anxiety and encourages banking participation.

Senior citizens and pensioners often maintain smaller balances relative to traditional minimum balance requirements. Many were unknowingly paying ₹300-₹500 monthly in penalties that could have gone toward healthcare or living expenses.

Low-income households in rural and semi-urban areas finally get genuine access to banking infrastructure without being financially punished for their circumstances.

Action Items: Making the Switch

Opening a zero-balance account is simpler than most people think. The entire process can be completed online within 15-30 minutes:

Visit your chosen bank’s website or mobile app and select the zero-balance or BSBD account option. You’ll need your Aadhaar number (linked to your mobile), PAN card, and a camera for video KYC verification. Fill in basic personal details, complete the video verification process with a bank representative, and receive your account number instantly.

If you already have a regular savings account and want to convert it to a zero-balance account, most banks will process this within seven days of your written request. Better still, the conversion can often be done through your mobile banking app.

Before making any switch, compare the interest rates offered by different zero-balance accounts. While interest rates are lower than investment instruments, the difference between 2.70% and 7.25% on even ₹50,000 amounts to ₹200-₹300 annually.

Final Thoughts

Banking shouldn’t be a financial drain. For too long, thousands of Indians have unknowingly subsidized banks through charges they didn’t understand and couldn’t easily avoid. The RBI’s revised zero-balance account regulations represent a genuine shift toward financial fairness.

From April 1, 2026, you’ll have the right—backed by explicit regulatory protection—to maintain a full-service bank account without maintaining a minimum balance. You’ll save ₹3,800-₹6,000 annually simply by eliminating wasteful charges. You’ll maintain complete access to digital payments, unlimited deposits, and basic banking services without any hidden conditions.

The question isn’t whether zero-balance accounts are worth it—the arithmetic proves they are. The real question is: why hasn’t everyone switched yet? The answer is changing. Make sure you’re among the first to take advantage of these new RBI protections.

Your future self will thank you for those ₹5,000+ in annual savings.

- Budget 2026: Why Your Marriage Certificate Could Be Your Biggest Tax-Saving Tool This YearBudget 2026 eyes joint taxation for couples—pool incomes, slash taxes by 20-30%! Save lakhs with optional filing. Explore how it beats income tax slabs, boosts tax savings, and what it means for your family finances. Will FM approve? Read now!

- Sunita Williams’ Secret: Astronaut Mindset That Builds Crores via SIP InvestingDiscover Sunita Williams’ astronaut mindset for wealth building: Solve crises “one bite at a time” like mutual fund SIP investing. Learn disciplined saving, risk pivots, and best mutual funds India strategies from her 27-year NASA career.

- HDFC Bank Q3 Surprise: Profit Jumps 11.5% – Why Experts Call It a ‘Screaming Buy’ at ₹930HDFC Bank’s Q3 FY26 results shine: 11.5% profit surge to ₹18,653 Cr, GNPA at 1.24%, deposits up 11.5%. Beats estimates amid deposit wars—strong buy for 2026? Stock eyes ₹1,000 breakout.

- Withdraw PF Money in Seconds? EPFO’s New UPI Update is the Game-ChangerDiscover EPFO UPI withdrawal: Instant PF access in minutes via PhonePe or Google Pay. Step-by-step guide, eligibility, benefits, and tax rules for 2026. Skip delays—empower your savings today!

- The Truth Behind the “TCS Employee Salary Drop”: Viral News, Variable Pay and What It Means for YouDiscover the real reasons behind the viral TCS employee salary drop. From variable pay cuts to strict WFO mandates and performance bands, learn why IT take-home pay is shrinking and how to protect your earnings effectively.

- This One No-Shop Weekend Hack Could Save You ₹50,000 Yearly—Here’s HowDiscover how one no-shop weekend monthly saves ₹50,000 yearly. Learn proven strategies to overcome impulse buying, build financial discipline, and transform weekend spending habits with our actionable no-spend challenge guide.

- The ₹1 Magic: Transform Pocket Change Into ₹1,378 With This Simple 52-Week PlanTransform your finances with India’s most popular 52-week money challenge. Save just ₹1 in week one, building to ₹52 by year-end for a total of ₹1,378. Discover the reverse challenge, practical tips, and how consistent saving habits create lasting financial freedom.

- Stop! Don’t “Liquidate” Your ₹500 Notes Yet: What the New RBI Circular Actually SaysGOI debunks viral ₹500 note discontinuation rumor. Fake news claimed RBI would ban notes by March 2026. Official clarification: ₹500 notes remain legal tender, ATMs continue dispensing them. Learn how to spot fake currency news and verify financial information.

- Cheques are Making a Huge Comeback in India—and They’re Now as Fast as UPI!India’s real-time cheque clearing system launched October 2025, processing cheques in hours instead of days. While Phase 2 was postponed, Phase 1 delivers same-day clearing with auto-approval features. Learn how continuous clearing speeds up banking for businesses and freelancers.

- You’re Already Using It: The Hidden ‘Embedded Finance’ Revolution Taking Over India in 2026India’s embedded finance market is exploding in 2026. Learn how UPI evolved into digital assets, BNPL transformed shopping, and financial services seamlessly integrated into your favorite apps. Discover five major trends reshaping how regular Indians manage money today.

Pingback: Withdraw PF Money in Seconds? EPFO’s New UPI Update is the Game-Changer