Remember the days when making a payment meant standing in long bank queues, filling out multiple forms, and waiting days for clearance? Then came UPI, and overnight, India’s digital payment landscape transformed. Today, we’re standing at the edge of a similar revolution—this time in insurance. Enter Bima Sugam, India’s ambitious digital insurance marketplace that promises to make buying, managing, and claiming insurance as simple as sending money through UPI.

Officially launched by the Insurance Regulatory and Development Authority of India (IRDAI) in September 2025, with full transactional features expected by December 2025, Bima Sugam represents a paradigm shift in how Indians interact with insurance. For a country where insurance penetration stands at just 3.7% of GDP—far below the global average of 6.8%—this platform could be the catalyst that brings “Insurance for All by 2047” from vision to reality.

What Exactly is Bima Sugam?

Bima Sugam translates to “easy insurance” in Hindi, and that’s precisely what it aims to deliver. Think of it as the Amazon of insurance—a unified digital marketplace where every IRDAI-licensed insurance company comes together on a single platform. But unlike private aggregators such as Policybazaar that primarily focus on lead generation and policy distribution, Bima Sugam offers something far more comprehensive: end-to-end insurance services including claim settlement, policy servicing, renewals, and grievance redressal.

The platform is operated by the Bima Sugam India Federation (BSIF), a not-for-profit entity jointly owned by life insurers, general insurers, health insurers, and intermediaries. This ownership structure ensures no single entity dominates the platform, keeping it neutral, transparent, and focused on public interest rather than commercial gain.

The Digital Public Infrastructure Vision

Bima Sugam isn’t just another insurance website—it’s being built as Digital Public Infrastructure (DPI), similar to how UPI revolutionized payments and Aadhaar transformed identity verification. It seamlessly integrates with India Stack APIs, including Aadhaar, PAN, DigiLocker, and the Account Aggregator framework, creating an interconnected ecosystem that makes insurance transactions smooth, secure, and paperless.

The platform forms a crucial pillar of IRDAI’s “Bima Trinity” initiative—comprising Bima Sugam (the digital marketplace), Bima Vahak (women-led distribution network), and Bima Vistaar (affordable micro-insurance products)—all working together to achieve universal insurance coverage.

Key Features That Will Transform Your Insurance Experience

1. Your Personal Insurance Hub: The e-Bima Account

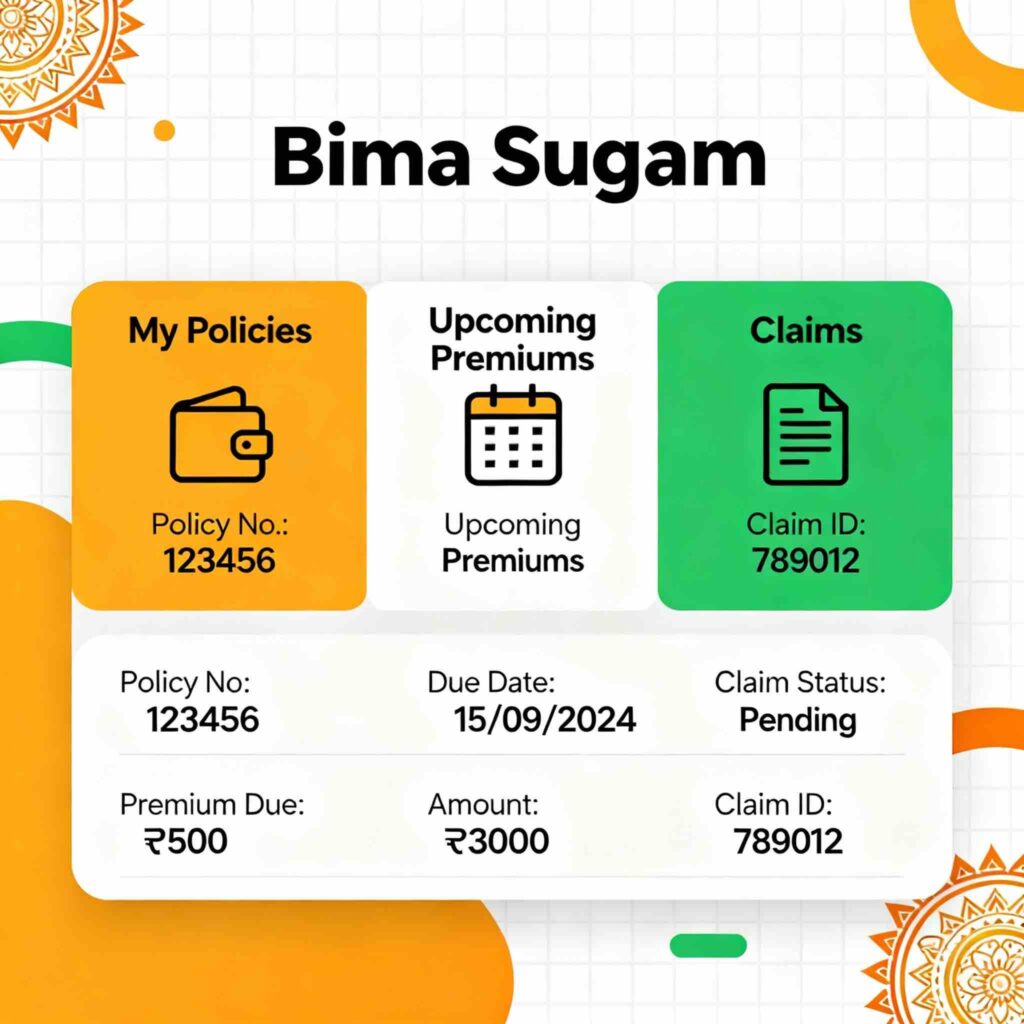

Just as Demat accounts revolutionized how we hold stocks and securities, Bima Sugam introduces the e-Bima Account—your personal digital insurance locker. This unified dashboard stores all your insurance policies in one place, regardless of which company issued them. No more hunting through physical files or worrying about lost documents during emergencies. Every policy you’ve ever purchased, every claim you’ve filed, every renewal reminder—all accessible with a single login.

2. Bima Pehchaan ID: Your Unique Insurance Identity

The cornerstone of Bima Sugam is the Bima Pehchaan ID—a unique digital identifier linked to your Aadhaar or PAN card. This single ID becomes your passport to the entire insurance ecosystem. Whether you’re buying a new policy, filing a claim, or updating your address across multiple policies, your Bima Pehchaan ID streamlines everything. Think of it as your insurance fingerprint—one identity that follows you across all insurers, eliminating the need for repeated KYC verification.

3. Compare Before You Buy: Transparent Product Comparison

One of Bima Sugam’s most powerful features is its neutral product comparison engine. Unlike private aggregators that may prioritize products offering higher commissions, Bima Sugam displays all policies side-by-side with complete transparency—premiums, coverage limits, exclusions, claim settlement ratios, waiting periods, and more. This empowers you to make informed decisions based on actual product merit, not sales pressure.

4. Paperless is the New Normal

Say goodbye to printing, scanning, and courier services. Bima Sugam embraces 100% paperless operations through e-KYC, DigiLocker integration, and digital signatures. Policy documents are instantly delivered to your e-Bima Account, claims can be filed by uploading photos from your phone, and premium payments happen with a tap through UPI or net banking.

5. Real-Time Claim Tracking and Faster Settlements

Perhaps the most anxiety-inducing part of insurance is claim settlement. Bima Sugam tackles this with real-time claim tracking that shows you exactly where your claim stands—whether it’s under review, what documents are needed, or when payment will be processed. In advanced scenarios, integration with hospitals and TPAs could enable cashless claim settlements within minutes, with approval arriving before you’re discharged.

6. All Insurance Types Under One Roof

Bima Sugam isn’t limited to one insurance category. It covers the entire spectrum:

- Life Insurance: Term plans, ULIPs, endowment policies, pension plans, annuities

- Health Insurance: Individual and family floaters, critical illness, disease-specific covers

- Motor Insurance: Two-wheeler, car, commercial vehicle—both third-party and comprehensive

- Travel Insurance: Domestic and international coverage

- Personal Accident Insurance: Individual and group policies

- Commercial Insurance: Property, marine, agricultural, business-specific products

7. Multilingual Support and Voice Assistance

Recognizing India’s linguistic diversity, Bima Sugam offers interfaces in multiple regional languages with voice assistance. This breaks down barriers for non-English speakers, particularly in rural and semi-urban areas where insurance penetration remains critically low.

8. Centralized Grievance Redressal System

When things go wrong, Bima Sugam provides a built-in complaint tracking and resolution mechanism. You can raise grievances, escalate to the Insurance Ombudsman if needed, and track resolution progress—all within the platform. This centralized approach ensures accountability and faster redressal compared to navigating individual insurer complaint systems.

The Benefits That Matter to You

Absolute Transparency: No More Hidden Clauses

Insurance documents are notoriously complex, filled with jargon and fine print. Bima Sugam mandates standardized product displays with clear explanations of coverage, exclusions, waiting periods, and claim procedures. What you see is exactly what you get—no surprises when you file a claim.

Cost Savings Through Minimal Commissions

Private distributors often earn 15-40% of first-year premiums as commission, costs that ultimately get passed to you through higher premiums. Bima Sugam operates on a low-cost, not-for-profit model with minimal intermediary margins. This could translate to meaningfully lower premiums, especially for straightforward products like term insurance and motor insurance.

Convenience That Saves Time

Managing insurance across multiple platforms—each with different login credentials, interfaces, and processes—is exhausting. Bima Sugam’s single-window approach eliminates this friction. Compare products from 25 life insurers and 34 general insurers without visiting multiple websites. Renew all policies from one dashboard. Update contact information once and have it reflected across all insurers.

Security and Privacy by Design

Bima Sugam employs strong authentication mechanisms, data encryption, and consent-based information sharing. You control what data gets shared and with whom. Built on India Stack principles, the platform adheres to the highest security standards, ensuring your personal and financial information remains protected.

Financial Inclusion: Reaching Every Corner of India

With over 700 million active internet users, including 425 million in rural areas, Bima Sugam can reach populations traditionally underserved by the insurance sector. The platform’s multilingual interface, simplified processes, and integration with Bima Vahak (grassroots distribution network) aim to make insurance accessible to farmers, small business owners, and rural families who’ve been left behind.

Lifetime Policy Access

Your digital insurance records stay with you forever. Even decades later, when you need to reference an old policy or track claims history, everything remains accessible through your e-Bima Account—a permanent, secure archive of your entire insurance journey.

How to Get Started: Your Registration Roadmap

Current Status (October 2025)

As of now, the Bima Sugam website (bimasugam.co.in) has been officially launched and serves as an information hub. The platform is being rolled out in phases, with full customer transactional access expected by December 2025. Initially, insurers and intermediaries are completing backend integrations, and the first products to go live will likely be health insurance, followed by life insurance and other categories.

What You Should Prepare Now

To hit the ground running when Bima Sugam goes fully live, keep these documents ready:

- Aadhaar card (for e-KYC and Bima Pehchaan ID creation)

- PAN card (alternative authentication method)

- Active mobile number (linked to Aadhaar for OTP verification)

- Email address (for policy communications)

- Existing policy details (policy numbers, insurer names—if you want to link existing policies)

Expected Registration Process (When Platform Goes Live)

Based on official announcements and industry standards, here’s how registration will likely work:

Step 1: Visit the Official Website

Navigate to bimasugam.co.in from your computer or mobile device.

Step 2: Start Registration

Click on “Register” or “Sign Up” (exact terminology may vary). You’ll be asked to provide your mobile number.

Step 3: OTP Verification

Enter the OTP received on your mobile to verify your number.

Step 4: Complete e-KYC

Choose your preferred KYC method:

- Aadhaar-based e-KYC: Enter your Aadhaar number and complete biometric/OTP authentication

- PAN-based KYC: Provide PAN number and date of birth for verification

Step 5: Create Your Bima Pehchaan ID

The system will generate your unique Bima Pehchaan ID—your permanent insurance identity across all insurers. Save this ID securely; you’ll need it for all future transactions.

Step 6: Set Up Your e-Bima Account

Create login credentials (username and password) for accessing your digital insurance dashboard.

Step 7: Link Existing Policies (Optional)

If you already have insurance policies, you can link them to your e-Bima Account by providing policy numbers and insurer details. This brings all your existing coverage under one unified view.

Step 8: Start Exploring

Once registered, you can browse insurance products, compare plans, check premium quotes, and when transactional features go live, purchase policies directly.

Important Notes for Early Adopters

- Phased Rollout: Not all features will be available immediately. Expect gradual addition of product categories and services.

- Initial Product Availability: The first phase will likely feature e-KYC modules and 2-3 insurance products, starting with health insurance.

- Insurer Integration Timeline: As insurers complete their system integrations, more products and services will become available throughout late 2025 and early 2026.

- Stay Updated: Regularly check bimasugam.co.in for announcements about feature launches and new product availability.

How Bima Sugam Differs from Policybazaar and Other Platforms

Understanding what sets Bima Sugam apart is crucial for appreciating its potential impact.

Ownership and Objectives

Private Aggregators like Policybazaar, Coverfox, and Turtlemint are for-profit companies driven by commercial interests. Their revenue model depends on commissions from insurers, which can create conflicts of interest when recommending products.

Bima Sugam, in contrast, is a not-for-profit entity jointly owned by insurers, intermediaries, and the broader insurance ecosystem. Its primary objective is public service—increasing insurance penetration and improving customer experience, not maximizing profits.

Product Coverage and Neutrality

Private Aggregators partner with select insurers, meaning you only see products from companies they have tie-ups with. Rankings and recommendations may be influenced by backend commercial agreements—products offering higher commissions might be promoted more prominently.

Bima Sugam mandates neutral, unbiased product listings from all IRDAI-licensed insurers. No preferential treatment, no commission-based rankings—just transparent, side-by-side comparisons based on actual product features.

Scope of Services

Private Aggregators primarily focus on policy distribution—helping you discover and buy insurance. While they may assist with initial queries, actual policy servicing, renewals, and claim settlements typically happen directly with the insurer or through their platforms.

Bima Sugam offers comprehensive lifecycle management:

- Product comparison and purchase

- Policy storage in digital locker

- Automated renewals with reminders

- Claim filing and real-time tracking

- Grievance redressal and Ombudsman escalation

- Policy portability between insurers

Commission Structures

Private Aggregators operate on sales-driven commission models where earnings are tied to policy sales volume. This creates inherent incentives to push certain products over others.

Bima Sugam employs transparent, capped commission structures or potentially token-based fees that don’t incentivize mis-selling. The focus shifts from maximizing commissions to providing the right product for customer needs.

Integration with Digital Infrastructure

Private Aggregators are standalone platforms with limited integration into broader digital ecosystems.

Bima Sugam is built as Digital Public Infrastructure, deeply integrated with India Stack components—Aadhaar, DigiLocker, Account Aggregator framework, ABHA (health records), and more. This enables seamless data sharing, instant verification, and interoperability across government and financial services.

India’s Insurance Landscape: Why Bima Sugam Matters Now

To appreciate Bima Sugam’s significance, consider the current state of India’s insurance sector:

Massive Untapped Potential

- Insurance penetration: Just 3.7% of GDP (2024), compared to the global average of 6.8%

- Life insurance penetration: Only 2.8% of GDP

- General insurance penetration: Merely 1% of GDP, against the global average of 4.2%

- Mortality protection gap: A staggering $16.5 trillion (83%) as of 2021

Rapid Growth Trajectory

Despite low penetration, India’s insurance market is growing robustly:

- Total premiums reached ₹11.2 lakh crore in FY24, with 7.7% year-on-year growth

- Projected to grow 123% by 2030, reaching ₹25 lakh crore

- India is expected to be the fastest-growing insurance market among G20 nations over 2025-2029, with 7.3% average annual growth

- Life insurance premiums forecast to grow 6.9% annually (2025-29)

- Non-life insurance expected to expand 7.3% annually

Current Challenges

Several structural issues hinder insurance adoption:

- Complexity: Varying forms, processes, and terms across insurers confuse customers

- Lack of transparency: Hidden clauses and unclear exclusions erode trust

- High distribution costs: Commissions inflate premiums, making insurance expensive

- Limited reach: Traditional channels don’t effectively serve rural and semi-urban populations

- Poor claim experience: Lengthy settlement processes and documentation hurdles frustrate policyholders

The Bima Sugam Solution

By addressing these pain points through standardization, digitization, transparency, and cost reduction, Bima Sugam can unlock India’s insurance potential. If successful, it could accelerate insurance penetration from 3.7% today to the government’s aspirational target of broader coverage by 2047, protecting millions of families from financial shocks.

What the Future Holds: Roadmap and Expectations

Phased Rollout Timeline

September 2025: Official website launch and public announcement by IRDAI Chairman

October-November 2025: Continued integration by insurers and intermediaries; backend system testing

December 2025: First phase goes live with e-KYC module and initial products (health and life insurance)

Early 2026: Progressive addition of more product categories—motor, travel, commercial insurance

2026 onwards: Full feature availability including advanced claim settlement, policy portability, and sandbox product innovations

Integration and Ecosystem Building

- All IRDAI-licensed insurers (25 life and 34 general insurance companies) will be onboarded

- Intermediaries, agents, and brokers will have access to sell through the platform with transparent commission tracking

- Banks and fintech platforms may integrate Bima Sugam APIs for embedded insurance offerings

- Health ecosystem integration: ABHA (Ayushman Bharat Health Account) linkage for instant medical history access during underwriting and claims

- Account Aggregator framework: Enables consent-based financial data sharing for better risk assessment

Product Innovation and Expansion

Bima Sugam’s infrastructure will accelerate the launch of innovative insurance products:

- Bite-sized or sachet insurance: Affordable micro-policies for specific needs (mobile insurance, disease-specific covers)

- Usage-based insurance: Pay-as-you-drive motor policies, activity-based health plans

- Climate risk insurance: Coverage for agricultural losses, natural disasters

- Cyber insurance: Protection against digital threats for individuals and businesses

- Electric vehicle insurance: Specialized products for India’s growing EV market

Goal: Insurance for All by 2047

Bima Sugam is central to achieving the “Insurance for All by 2047” vision under Viksit Bharat 2047. Success will be measured by:

- Insurance penetration increasing from 3.7% to at least 6-7% of GDP by 2035

- Rural insurance coverage expanding significantly through digital reach

- Claim settlement ratios improving above 95% across the industry

- Customer satisfaction scores rising with transparent, efficient service delivery

- Protection gap narrowing as more families secure adequate life and health coverage

Impact on Insurance Agents: Evolution, Not Elimination

There’s concern in agent communities that Bima Sugam might disintermediate traditional distributors. However, IRDAI has built safeguards and opportunities for agents to thrive in the new ecosystem:

Agents Can Continue Operating Through Bima Sugam

Registered agents and intermediaries will have access to the platform with digital tools to serve clients more efficiently. All transactions, commissions, and customer relationships will be digitally recorded, bringing transparency and accountability.

Shift from Sellers to Advisors

Rather than being eliminated, agents will evolve from product pushers to trusted advisors. As product information becomes transparent and accessible, the value proposition shifts:

- Complex needs analysis: Helping customers with intricate insurance requirements (estate planning, business coverage)

- Personalized advisory: Guiding clients through life stage-based insurance strategies

- Claim assistance: Supporting customers during the emotionally difficult claims process

- Portfolio optimization: Reviewing and updating coverage as family circumstances change

Digital Tools Enhance Productivity

Agents gain access to powerful digital capabilities:

- Instant policy issuance without paperwork delays

- Real-time commission tracking and payment

- Centralized customer portfolio management

- Automated renewal reminders reducing manual follow-ups

- Data analytics for identifying cross-sell and up-sell opportunities

The most successful agents will be those who embrace digital transformation, leverage Bima Sugam’s infrastructure, and focus on delivering high-touch advisory services that technology cannot replicate.

Your Action Plan: Get Ready for the Insurance Revolution

As Bima Sugam prepares for full launch, here’s how you can prepare:

For Individual Consumers

- Bookmark bimasugam.co.in and check regularly for launch updates

- Ensure your Aadhaar is updated with current mobile number and address

- Take stock of existing insurance policies—gather policy numbers and insurer details

- Identify coverage gaps—do you have adequate life cover? Health insurance for family? Sufficient motor coverage?

- Educate yourself on basic insurance terms so you can make informed comparisons when the platform goes live

For Insurance Professionals

- Register as an intermediary on Bima Sugam once agent/broker onboarding begins

- Invest in digital skills—learn to navigate online platforms, use CRM tools, and conduct virtual consultations

- Shift your value proposition—focus on advisory services, not just product pushing

- Build strong customer relationships—in a transparent marketplace, trust and personalized service become differentiators

- Stay informed about IRDAI regulations and Bima Sugam feature releases

For Businesses and Employers

- Plan to review corporate insurance policies through Bima Sugam for better rates and coverage

- Consider offering voluntary benefits—employee-paid supplemental insurance becomes easier through the platform

- Integrate with Bima Sugam APIs if you’re a fintech or HR-tech platform for embedded insurance offerings

- Train HR teams on how to guide employees through Bima Sugam for personal insurance needs

Conclusion: India’s UPI Moment for Insurance is Here

Just as few predicted how completely UPI would transform India’s payment ecosystem, we might be underestimating Bima Sugam’s potential to revolutionize insurance. The infrastructure is being laid for a future where:

- Buying insurance takes minutes, not days

- Comparing 50+ products happens on a single screen with complete transparency

- Filing claims involves uploading a photo from your hospital bed and receiving approval before discharge

- Renewals happen automatically with smart reminders and seamless payments

- Grievances get resolved quickly through centralized tracking and accountability

For a country with over 1.4 billion people and insurance penetration below 4%, the potential impact is staggering. Millions of families who currently lack basic life and health coverage could finally access affordable protection. Small business owners could secure their livelihoods against unforeseen risks. Farmers could protect crops from climate uncertainties. Senior citizens could find suitable health plans without navigating complex jargon.

Bima Sugam isn’t just a technology platform—it’s a catalyst for financial inclusion and social protection on a scale India has never seen. As December 2025 approaches and the first transactions go live, we’re witnessing the early chapters of a transformation that will reshape Indian insurance for decades to come.

The insurance revolution is here. Are you ready to join it?

Disclaimer: Information in this article is based on official IRDAI announcements, press releases, and industry reports available as of October 2025. Features, timelines, and processes may change as the platform evolves. Always refer to the official Bima Sugam website for the most current information before making insurance decisions.

- HDFC Bank Q3 Surprise: Profit Jumps 11.5% – Why Experts Call It a ‘Screaming Buy’ at ₹930HDFC Bank’s Q3 FY26 results shine: 11.5% profit surge to ₹18,653 Cr, GNPA at 1.24%, deposits up 11.5%. Beats estimates amid deposit wars—strong buy for 2026? Stock eyes ₹1,000 breakout.

- Withdraw PF Money in Seconds? EPFO’s New UPI Update is the Game-ChangerDiscover EPFO UPI withdrawal: Instant PF access in minutes via PhonePe or Google Pay. Step-by-step guide, eligibility, benefits, and tax rules for 2026. Skip delays—empower your savings today!

- The Truth Behind the “TCS Employee Salary Drop”: Viral News, Variable Pay and What It Means for YouDiscover the real reasons behind the viral TCS employee salary drop. From variable pay cuts to strict WFO mandates and performance bands, learn why IT take-home pay is shrinking and how to protect your earnings effectively.

- Stop! Don’t “Liquidate” Your ₹500 Notes Yet: What the New RBI Circular Actually SaysGOI debunks viral ₹500 note discontinuation rumor. Fake news claimed RBI would ban notes by March 2026. Official clarification: ₹500 notes remain legal tender, ATMs continue dispensing them. Learn how to spot fake currency news and verify financial information.

- Cheques are Making a Huge Comeback in India—and They’re Now as Fast as UPI!India’s real-time cheque clearing system launched October 2025, processing cheques in hours instead of days. While Phase 2 was postponed, Phase 1 delivers same-day clearing with auto-approval features. Learn how continuous clearing speeds up banking for businesses and freelancers.

- Planning a Gold Loan in 2026? This New RBI Rule Could Slash Your Cash by Thousands OvernightApril 2026 brings RBI’s new gold loan regulations with tiered LTV limits: 85% for loans under ₹2.5 lakh, 80% for ₹2.5–5 lakh, and 75% above. Understand how these rules impact your borrowing capacity and protect your precious ornaments.

- Why Your Old Chequebook Might Stop Working: Understanding India’s Bold Bank ConsolidationExplore India’s ambitious PSU bank consolidation strategy reshaping the financial sector. Understand recent mergers, the government’s FY27 mega plan, and how bank consolidation impacts customers, employees, and the broader banking ecosystem.

- Big Relief for Businesses: RBI Relaxes Current Account Norms; Major Changes Effective April 2026The RBI’s December 2025 amendments fundamentally reshape business financing by removing restrictions on cash credit accounts and raising current account thresholds to Rs 10 crore. These relaxations in current and cash credit norms enhance working capital accessibility, enabling businesses to optimize liquidity management and reduce operational financing costs significantly.

- One Rule for All: How RBI’s Standardized Minimum Balance Will Change Your Banking in 2026The Reserve Bank of India’s updated minimum balance framework, effective December 10, 2025, reduces penalties to ₹200 maximum and introduces flexible thresholds. Urban savings accounts require ₹500 minimum, rural accounts ₹200, while zero balance BSBD accounts eliminate requirements entirely, promoting financial inclusion across India’s banking sector.

- No More Shortcuts: RBI Plugs Regulatory Gaps for NBFCs and HFCs in Landmark December AmendmentThe RBI’s December 2025 amendment extends regulatory oversight to Non-Banking Financial Companies and Housing Finance Companies within banking groups. This consolidated supervisory framework eliminates regulatory gaps, enforces harmonized prudential standards, and ensures comprehensive group-level risk management across India’s financial services sector.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for your feedback! Please subscribe my channel for more such contents and share it with your friends and family. You may reach me at avpatra09@gmail.com