From higher grocery bills to expensive appliances, families across India have felt the pinch of taxes on everyday essentials. But the historic GST reform announced on September 3, 2025, changes everything—making life more affordable while shielding the economy from global trade uncertainties.

Meet Rahul Sharma, a software engineer from Bengaluru earning ₹8 lakh annually. Like millions of middle-class families, Rahul carefully budgets every rupee. His monthly grocery bill of ₹12,000 includes packaged foods, personal care items and household essentials. Under the old GST system, he was paying extra taxes that often felt unfair. The September 22, 2025 GST overhaul just changed his family’s financial equation dramatically.

What Actually Changed: GST 2.0 Explained Simply

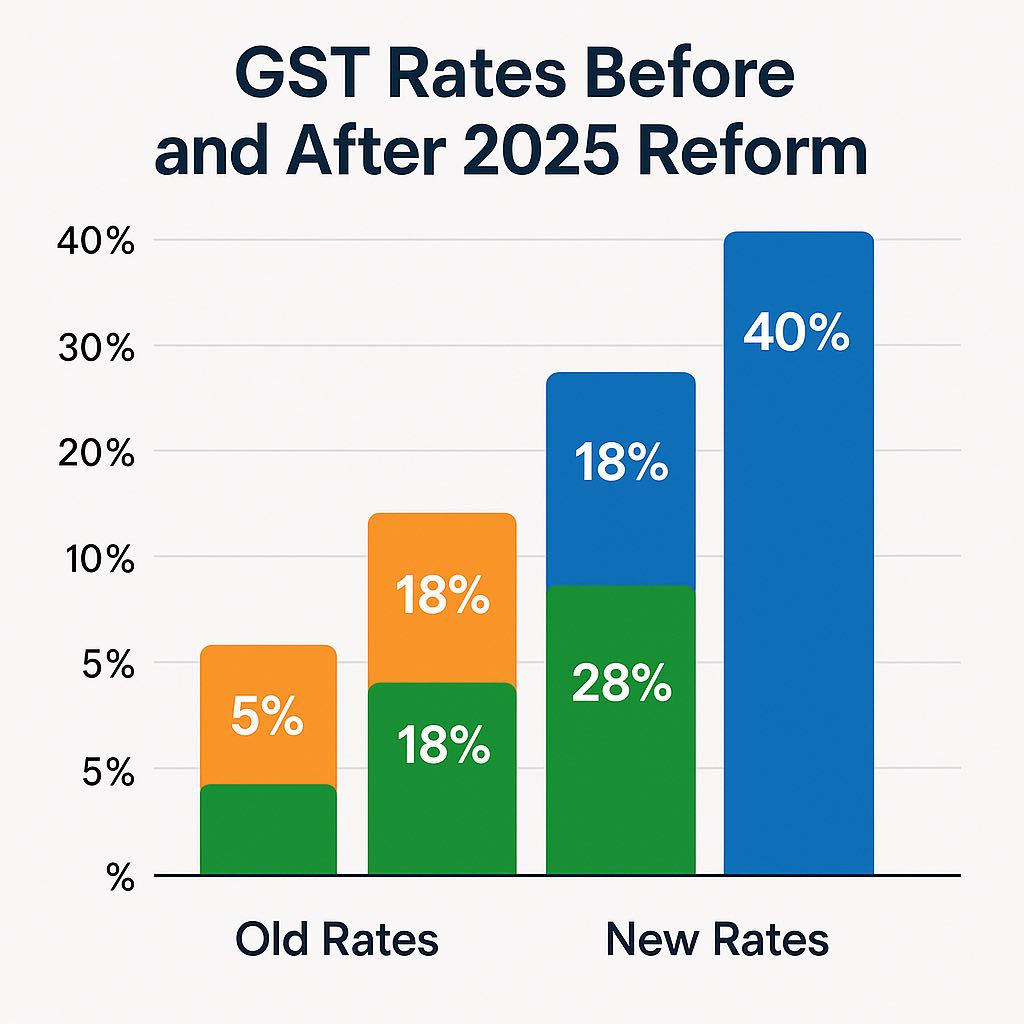

India’s Goods and Services Tax got its biggest makeover since 2017 by slashing the complex four-slab system (5%, 12%, 18%, 28%) into just two main rates i.e 5% and 18%. A special 40% rate applies only to luxury items like high-end cars, tobacco, and sin goods.

The transformation is remarkable: 396 everyday items just became cheaper, from toothpaste and biscuits to televisions and small cars. Finance Minister Nirmala Sitharaman emphasized this was designed specifically for the “common man, farmers, MSMEs, and middle class“.

Real Impact: Rahul’s Monthly Savings

Let’s see how GST 2.0 affects Rahul’s typical monthly expenses:

Household Essentials & Food

| Item | Old GST Rate | New GST Rate | Monthly Spending | Monthly Savings |

|---|---|---|---|---|

| Packaged biscuits, namkeens | 18% | 5% | ₹800 | ₹88 |

| Toothpaste, shampoo, soap | 18% | 5% | ₹600 | ₹66 |

| Ghee, butter, processed foods | 12% | 5% | ₹1,200 | ₹84 |

| Utensils, kitchen items | 12% | 5% | ₹300 | ₹21 |

Insurance & Healthcare

| Item | Old GST Rate | New GST Rate | Annual Premium | Annual Savings |

|---|---|---|---|---|

| Health insurance premium | 18% | 0% | ₹25,000 | ₹4,500 |

| Life insurance premium | 18% | 0% | ₹20,000 | ₹3,600 |

Consumer Durables (One-time purchases)

| Item | Old GST Rate | New GST Rate | Price | Savings |

|---|---|---|---|---|

| LED TV (43-inch) | 28% | 18% | ₹35,000 | ₹3,500 |

| Air conditioner | 28% | 18% | ₹40,000 | ₹4,000 |

| Small car (if purchased) | 28%+cess | 18% | ₹6,00,000 | ₹60,000+ |

Rahul’s annual savings: Approximately ₹259 from monthly essentials plus ₹8,100 from insurance premiums. For a one-time purchase like an AC or TV, he saves an additional ₹67,500+. So, cumulatively he would be saving of ₹75K-80K directly from GST.

Banking Sector: The Big Winner

The GST reform creates a consumption boom that directly benefits banks and financial institutions through multiple channels:

Credit Growth Acceleration

Bank leaders are unanimously optimistic about the reform, SBI Chairman CS Setty projects that “demand and credit expansion will rise, driving economic growth” as households gain spending power. Punjab National Bank MD Ashok Chandra expects “substantial benefits with increased demand for credit” in retail, agriculture, MSME and renewable energy sectors.

Key Banking Benefits:

- Higher disposable income drives loan demand for homes, vehicles and consumer durables

- Lower appliance costs increase demand for consumer loans and EMI financing

- Reduced insurance premiums improve affordability, expanding the customer base for insurance linked investment products

- MSME relief from simplified compliance reduces business costs and improving credit quality

Credit Growth Projections

Despite cautious optimism due to US tariff uncertainties and banking analysts expect:

- Auto financing surge: Small cars and two-wheelers becoming cheaper drives vehicle loan demand

- Consumer durables financing: TVs, ACs and appliances at 18% (down from 28%) boost EMI-based purchases

- Home loans: Cement prices falling from 28% to 18% reduce construction costs, which is making home ownership more accessible

Shriram Finance Executive Vice-Chairman Umesh Revankar noted: “Demand is expected to grow sharply, creating greater need for business credit” alongside the festive season momentum.

Trump Tariffs vs GST Relief: India’s Economic Shield

The timing of GST 2.0 couldn’t be more strategic due to Trump’s 50% tariffs threatening to India’s exports, the domestic consumption boost provides crucial economic balance.

The Trade War Challenge

- US tariffs impact: Economists estimate 0.6-0.8 percentage points reduction in GDP growth due to export challenges

- Export vulnerability: 55 of India’s $87 billion US exports affected by tariffs

- Sectoral impact: Textiles, leather and chemicals face competitive disadvantage

GST 2.0 as Counter-Strategy

Economic cushion: GST rate cuts are projected to add 60-80 basis points to GDP growth, which is potentially offsetting tariff impacts. The ₹48,000 crore revenue impact will be recovered through higher consumption volumes.

SBI Chief Economist Soumya Kanti Ghosh confirms, “The consumption boost will more than neutralise any revenue impact“. Market analysts project GST reforms could add 100-120 basis points to GDP growth over 4-6 quarters.

Sector-Wise Impact: Who Wins Big

FMCG & Consumer Goods

- Biscuits, namkeens, packaged foods: 18% → 5% drives volume growth

- Personal care: Soaps, toothpaste and shampoos become significantly cheaper

- Rural penetration: Lower prices expand market reach in price-sensitive segments

Automotive Sector

- Small cars: Effective tax reduction from 31% to 18% for petrol cars under 1200cc

- Two-wheelers: Under 350cc motorcycles see substantial price drops

- Commercial vehicles: Reduced logistics costs from lower fuel and component taxes

Consumer Durables

- White goods: ACs, refrigerators and washing machines shift from 28% to 18%

- Electronics: TVs, computers, and appliances become more affordable

- Cement: Construction cost reduction benefits real estate and infrastructure

Healthcare & Insurance

- Life insurance: Zero GST makes policies more attractive

- Health insurance: Premium affordability improves penetration dramatically

- Medicines: 30+ specialized drugs now zero-rated

Middle Class: The Clear Winner

The reform specifically targets middle-class pain points. PM Modi emphasized benefits for “common man, farmers, MSMEs, middle-class, women and youth“.

Immediate Relief Areas:

- Food inflation: Lower taxes on packaged foods reduce grocery bills

- Healthcare costs: Insurance premium relief provides significant savings

- Aspirational purchases: Cars, appliances and electronics become more accessible

- Festival season: Timing maximizes impact during high-spending periods

Real-world impact: A family earning ₹10 lakh annually can save ₹15,000-₹25,000 annually through direct GST reductions and insurance savings.

Comparative Analysis: Before vs After GST 2.0

Tax Structure Simplification

| Category | Before GST 2.0 | After GST 2.0 |

|---|---|---|

| Tax slabs | 4 main slabs (5%, 12%, 18%, 28%) + cess | 2 main slabs (5%, 18%) + 40% for luxury |

| Compliance complexity | Multiple rates, frequent confusion | Simplified, predictable structure |

| Input tax credit | Limited for highest slab | Full ITC availability |

| Rate changes | Required GST Council approval | Streamlined process |

Consumer Impact Examples

| Product Category | Old Tax Burden | New Tax Burden | Consumer Benefit |

|---|---|---|---|

| Daily essentials | 12-18% | 5% or 0% | Direct price reduction |

| Consumer durables | 28% + cess (up to 45%) | 18% | 20-25% tax reduction |

| Insurance | 18% | 0% | Full tax elimination |

| Luxury items | 28% + cess (varies) | Flat 40% | Predictable, often lower |

Global Context: Learning from Success Stories

India’s GST simplification mirrors successful tax reforms globally:

International Comparisons

- Canada: GST simplification (1991) boosted economic efficiency and transparency

- Australia: GST introduction (2000) with careful rate structure improved competitiveness

- New Zealand: Simple, broad-based GST became model for efficiency

- Singapore: Low, uniform GST rates support consumption-driven growth

India’s approach combines simplification with social consideration—keeping essentials affordable while generating revenue from luxury consumption.

Challenges & Road Ahead

Implementation Considerations

- Revenue monitoring: ₹48,000 crore revenue impact requires careful tracking

- Compliance adaptation: Businesses need time to adjust systems and pricing

- State coordination: Ensuring uniform implementation across states

- Anti-profiteering: Monitoring to ensure consumer benefits reach end-users

Future Outlook

Economic multiplier effects: Beyond direct tax savings, GST 2.0 creates positive feedback loops:

- Higher disposable income → Increased consumption → Business growth → Job creation → More income

- Lower input costs → Business competitiveness → Export potential → Economic growth

- Simplified compliance → Better tax collection → Improved fiscal position

Bank credit growth: Expected to accelerate from current 10% to 12-14% as consumption demand drives lending.

Conclusion: A Win-Win for India’s Economy

GST 2.0 represents more than tax reform, its economic strategy designed for challenging times. By putting money back in middle-class pockets, simplifying business operations and creating consumption momentum, India builds domestic strength while global uncertainties persist.

For families like Rahul’s, the savings are immediate and meaningful. For banks, the credit growth opportunity is substantial. For the economy, the reform provides resilience against external trade pressures while fostering inclusive growth.

The September 22, 2025 implementation date marks not just lower taxes, but India’s commitment to making prosperity more accessible to ordinary citizens. In a world of rising protectionism and trade tensions, India’s choice to empower domestic consumption shows strategic wisdom. Sometimes, the best defence against global economic headwinds is making your own people more prosperous.

- Sunita Williams’ Secret: Astronaut Mindset That Builds Crores via SIP InvestingDiscover Sunita Williams’ astronaut mindset for wealth building: Solve crises “one bite at a time” like mutual fund SIP investing. Learn disciplined saving, risk pivots, and best mutual funds India strategies from her 27-year NASA career.

- HDFC Bank Q3 Surprise: Profit Jumps 11.5% – Why Experts Call It a ‘Screaming Buy’ at ₹930HDFC Bank’s Q3 FY26 results shine: 11.5% profit surge to ₹18,653 Cr, GNPA at 1.24%, deposits up 11.5%. Beats estimates amid deposit wars—strong buy for 2026? Stock eyes ₹1,000 breakout.

- Withdraw PF Money in Seconds? EPFO’s New UPI Update is the Game-ChangerDiscover EPFO UPI withdrawal: Instant PF access in minutes via PhonePe or Google Pay. Step-by-step guide, eligibility, benefits, and tax rules for 2026. Skip delays—empower your savings today!

- The Truth Behind the “TCS Employee Salary Drop”: Viral News, Variable Pay and What It Means for YouDiscover the real reasons behind the viral TCS employee salary drop. From variable pay cuts to strict WFO mandates and performance bands, learn why IT take-home pay is shrinking and how to protect your earnings effectively.

- The ₹1 Magic: Transform Pocket Change Into ₹1,378 With This Simple 52-Week PlanTransform your finances with India’s most popular 52-week money challenge. Save just ₹1 in week one, building to ₹52 by year-end for a total of ₹1,378. Discover the reverse challenge, practical tips, and how consistent saving habits create lasting financial freedom.

Если важны качественные ресурсы, подойдут базы форумов для xrumer https://www.olx.ua/d/uk/obyavlenie/progon-hrumerom-dr-50-po-ahrefs-uvelichu-reyting-domena-IDXnHrG.html с высокой репутацией.

Thanks for your feedback! Please subscribe my channel for more such contents and share it with your friends and family. You may reach me at avpatra09@gmail.com

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://bankermoney.com

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.