The digital banking landscape in India has undergone a seismic transformation, with the Unified Payments Interface (UPI) emerging as the undisputed champion of real-time payments. As we navigate through 2025 we find UPI isn’t just revolutionising how Indians transact it is also reshaping the entire global payments ecosystem and setting new benchmarks for financial innovation.

UPI’s Meteoric Rise: Numbers That Tell the Story

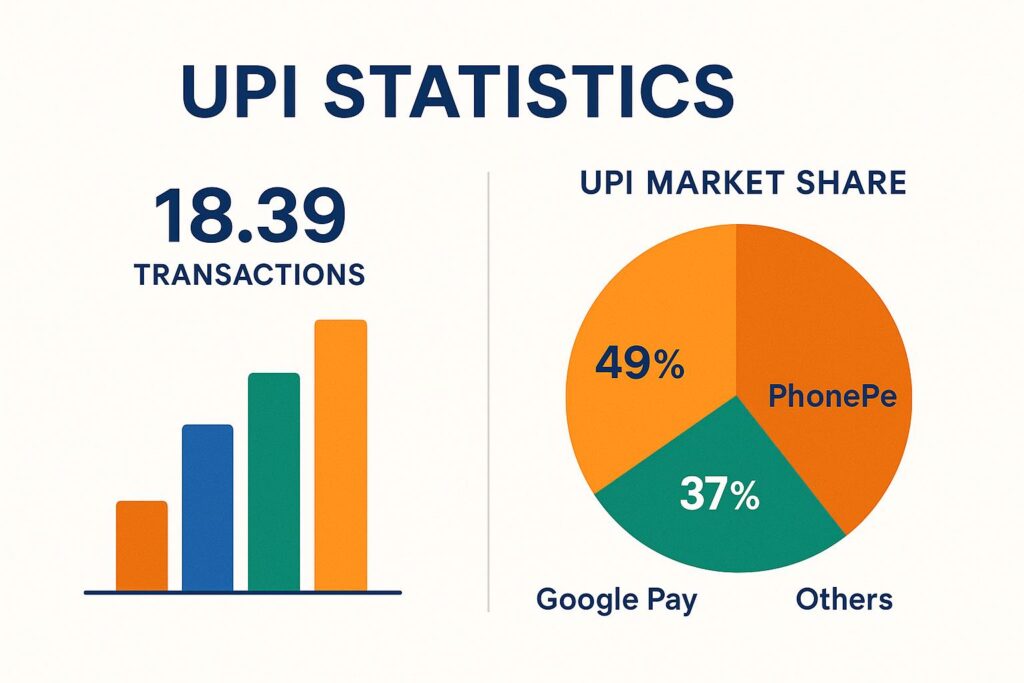

The statistics speak volumes about UPI’s incredible journey. In June 2025 alone, UPI processed over ₹24.03 lakh crore across 18.39 billion transactions—a staggering 32% increase from the previous year. Today, UPI accounts for 85% of all digital transactions in India and powers nearly 50% of global real-time digital payments.

With 491 million individuals and 65 million merchants connected across 675 banks on a single platform and UPI has created the world’s most comprehensive digital payments ecosystem. The platform now handles more than 640 million transactions daily by surpassing even Visa’s global transaction volume.

The Digital Banking Revolution: Beyond Just Payments

From Infrastructure to Ecosystem

What started as basic payment infrastructure has evolved into a comprehensive financial ecosystem. Banks initially viewed UPI as merely payment rails, but today’s reality is far more transformative. Top 5 banks dominating the UPI ecosystem include SBI (25-27% payer-side volume), HDFC Bank (~19%), ICICI Bank (~16%), Yes Bank (~40% merchant payments) and Axis Bank (~10% beneficiary share).

However, an uncomfortable truth emerges: while banks process the transactions, the customer mindshare has shifted decisively to third-party apps like PhonePe (49%), Google Pay (37%) and Paytm (7%). Users open these apps 25-30 times monthly but rarely visit their bank app, which creating a challenge for traditional financial institutions.

Key Innovation Drivers in 2025

1. UPI Credit Integration – The Game Changer

The integration of RuPay credit cards with UPI has been revolutionary. In the first seven months of FY25 UPI credit card transactions doubled year-on-year by reaching ₹638 billion. This feature eliminates the friction of card swiping and expands credit card usability across millions of merchants, especially in rural areas where UPI QR codes are ubiquitous.

2. UPI Lite with Auto Top-Up

UPI Lite launched on November 1, 2024, it enables low-value transactions via an on-device wallet to eliminating real-time bank connectivity needs. The auto top-up feature automatically reloads wallets when balance dips by ensuring seamless micro payments and reducing infrastructure load on banks.

3. Enhanced Financial Inclusion

UPI’s accessibility has brought millions into the financial fold, especially in rural areas with smartphones and affordable internet. Even small-scale merchants now accept UPI payments through UPI QR codes saw a 91.5% surge by reaching 657.9 million in early 2025.

Competitive Landscape Analysis: Learning from Success Stories

What Leading Players Are Doing Right

PhonePe Strategy: Dominating with 49% market share by focusing on merchant acquisition and seamless user experience.

Google Pay’s Approach: Leveraging Google’s ecosystem integration and localization strategies for 37% market share.

Banking Response: Progressive NBFCs like Bajaj Finance have invested heavily in digital transformation with 90% computing on cloud and 61 million+ app downloads.

Emerging Trends Shaping 2025

1. Credit Democratization

UPI-linked credit is opening doors for “new-to-credit” consumers lacking traditional credit scores. Banks are piloting secured credit cards and pre-approved small credit lines for first-time borrowers.

2. Debit Card Decline

Debit card usage plummeted 33% YoY in FY2024 with transactions shifting to UPI or UPI-linked credit cards and Debit cards now primarily serve ATM withdrawals rather than retail transactions.

3. International Expansion

UPI now facilitates international payments in select countries including Bhutan, France, Mauritius, Nepal, Singapore, Sri Lanka and UAE with plans for broader global adoption.

Insights: What This Means for You

For Consumers

Choose UPI when you need:

- Free real-time digital payments

- Simple grocery bills and P2P transfers

- Quick merchant payments without carrying cash

Choose Credit Cards when you need:

- Reward benefits and cashback programs

- EMI options for large purchases

- International travel and online shopping

For Businesses

Merchant Benefits:

- No POS terminal requirements with UPI QR codes

- Instant settlement compared to traditional card processing

- Lower transaction costs compared to credit card fees

- Access to credit through UPI credit lines for working capital

Security and Trust: Addressing the Concerns

While UPI transactions reached record highs of ₹485 crore lost to UPI payment frauds in the same financial year. This highlights the critical importance of robust security measures:

UPI Security Advantages:

- No sharing of bank account or card details

- PIN-based authorization system

- Virtual payment addresses (VPAs) for privacy

Best Practices for Safe Usage:

- Never share UPI PIN with anyone

- Verify merchant details before payment

- Use official UPI apps from trusted sources

- Enable transaction alerts and limits

The Road Ahead: Future of Digital Banking

Emerging Technologies

AI and Machine Learning: Banks are leveraging alternative data sources for dynamic credit scoring, especially for new-to-credit users. AI helps predict customer needs and automate workflows across lending and customer support.

Blockchain Integration: While still emerging some progressive financial institutions are exploring DeFi integrations for tokenized lending and transparent asset tracking.

IoT Integration: Embedded payments through IoT devices represent the next frontier, extending UPI reach beyond smartphones to smart devices and vehicles.

Regulatory Support

The Reserve Bank of India continues enabling innovation through:

- Increasing UPI transaction limits

- Flexible credit product linking

- Enhanced digital authentication measures

- International corridor expansion support

Conclusion: India’s Digital Banking Leadership

The digital banking revolution powered by UPI represents more than technological advancement, it’s a fundamental shift in how financial services are conceived, delivered and consumed. With projected growth from 16 billion monthly transactions in December 2024 to 54 billion by 2030, now UPI trajectory points toward unprecedented scale.

For consumers, this evolution means greater convenience, lower costs and expanded financial access. For businesses, it represents opportunities for innovation, efficiency and growth. For the banking sector, it demands strategic rethinking about customer engagement, product delivery and competitive positioning.

As we progress through 2025, one thing is clear that India’s UPI revolution isn’t just transforming domestic payments but also setting the global standard for what digital banking can achieve. The question is not whether this transformation will continue, but how quickly other nations can adapt India’s successful model for their own financial ecosystems.

- HDFC Bank Q3 Surprise: Profit Jumps 11.5% – Why Experts Call It a ‘Screaming Buy’ at ₹930HDFC Bank’s Q3 FY26 results shine: 11.5% profit surge to ₹18,653 Cr, GNPA at 1.24%, deposits up 11.5%. Beats estimates amid deposit wars—strong buy for 2026? Stock eyes ₹1,000 breakout.

- Withdraw PF Money in Seconds? EPFO’s New UPI Update is the Game-ChangerDiscover EPFO UPI withdrawal: Instant PF access in minutes via PhonePe or Google Pay. Step-by-step guide, eligibility, benefits, and tax rules for 2026. Skip delays—empower your savings today!

- The Truth Behind the “TCS Employee Salary Drop”: Viral News, Variable Pay and What It Means for YouDiscover the real reasons behind the viral TCS employee salary drop. From variable pay cuts to strict WFO mandates and performance bands, learn why IT take-home pay is shrinking and how to protect your earnings effectively.

- Stop! Don’t “Liquidate” Your ₹500 Notes Yet: What the New RBI Circular Actually SaysGOI debunks viral ₹500 note discontinuation rumor. Fake news claimed RBI would ban notes by March 2026. Official clarification: ₹500 notes remain legal tender, ATMs continue dispensing them. Learn how to spot fake currency news and verify financial information.

- Cheques are Making a Huge Comeback in India—and They’re Now as Fast as UPI!India’s real-time cheque clearing system launched October 2025, processing cheques in hours instead of days. While Phase 2 was postponed, Phase 1 delivers same-day clearing with auto-approval features. Learn how continuous clearing speeds up banking for businesses and freelancers.

Pingback: How to Double Your UPI Cashback Earnings in 2025