In the fast-paced world of the Indian IT sector, salary hikes are usually the headline. But recently, a different kind of story has taken the internet by storm, a shocking report of a TCS employee salary drop.

Imagine working for over five years at India’s largest IT services firm, only to find your take-hand pay is lower today than when you joined. Sounds like a corporate nightmare, right?

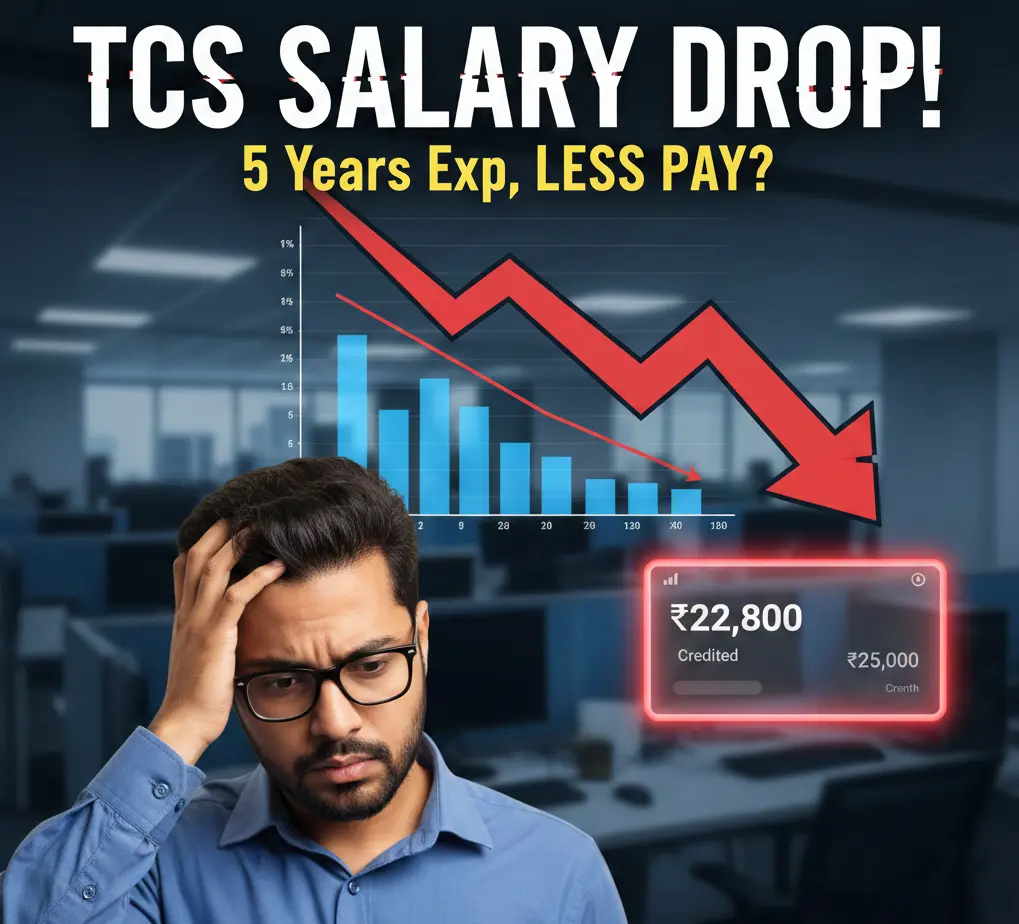

If you’ve been Googling “TCS variable pay cut”,”TCS increment news 2025″ or just trying to make sense of your own payslip, you aren’t alone. The recent viral Reddit post by a techie claiming his salary dipped from ₹25,000 to ₹22,800 has triggered a massive debate about TCS performance bands, appraisal policies and the reality of the IT sector salary trends in India.

Let’s decode what is actually happening, why some paychecks are shrinking, and how you can safeguard your career in this volatile market.

The Viral Story: How Can a Salary Actually Drop?

The buzz started with a candid confession on a developer forum. A TCS employee, who joined in 2020 with a modest ₹25,000 monthly salary; revealed that after 5.5 years, his earnings had slid to ~₹22,800.

For most of us, “salary revision” implies an increase. So, how does a TCS employee salary drop happen mathematically?

The culprit isn’t a reduction in your “Basic Pay” that remains legally protected in most cases. The drop usually stems from the variable pay component. In this specific viral case, the employee admitted to consistently receiving low performance ratings (C or D bands) and being placed on a Performance Improvement Plan (PIP) due to a lack of upskilling.

When you consistently hit the lower rungs of the TCS appraisal system, two things happen:

- Zero Increments: You miss out on the annual TCS salary hike.

- Variable Pay Erosion: The performance-linked incentive (or quarterly variable allowance) can be slashed significantly, leading to a lower “in-hand” figure than before.

Beyond the Viral Post: The Broader Reasons for Pay Cuts

While the viral story was an extreme case of performance stagnation in other side many high-performing employees are also feeling the pinch. If your salary credit looks lighter than usual as it might be due to recent policy shifts rather than your coding skills.

1. The “Return to Office” Mandate

One of the biggest factors affecting payouts recently has been the TCS work from office policy. To encourage a return to desk culture, the company has explicitly linked variable pay eligibility to office attendance.

Reports from late 2024 and 2025 suggest that employees failing to meet the mandatory 5-day office week could see their variable pay cut or even face an appraisal freeze. If you’ve been working remotely without official exemption and this compliance check is likely why your variable component has taken a hit.

2. Variable Pay Policy Changes

TCS has historically been generous with quarterly variable allowances (QVA), often paying out 100%. However, recent TCS variable pay news indicates a shift. While junior employees (freshers and lower grades) have largely been protected with full payouts and mid-to-senior level employees have seen their bonuses tied strictly to business unit performance.

If your unit had a slow quarter, your variable pay and thus your total monthly credit could drop even if you personally worked hard.

3. Increment Delays and Market Slowdown

The TCS increment delays in 2025 left many anxious. Instead of the usual April rollout, hikes were pushed to September for many associates. When inflation rises but salaries stagnate (or “drop” due to variable cuts) the real value of your income feels significantly lower.

This isn’t just a TCS issue; it’s a symptom of broader IT sector salary trends. With global clients tightening budgets and the AI wave disrupting traditional service models and companies are focusing intensely on cost optimization.

Is Your Job Safe? The “Upskill or Perish” Reality

The harsh reality highlighted by the viral TCS employee salary drop story is the danger of complacency. The employee admitted to focusing on government exams rather than upskilling in Java or backend technologies.

In the current market, “years of experience” no longer guarantees a higher salary. Companies are paying for relevance not tenure. If you are stuck in a legacy technology with a high salary package, you are a prime target for cost-cutting measures.

How to Protect Your Paycheck

If you are worried about falling into the “salary drop” trap, here is your survival guide:

- Check Your Band: actively monitor your quarterly performance bands. If you hit a ‘C’ band then treat it as an immediate red flag.

- Comply with WFO: It might be inconvenient, but if your TCS variable pay depends on swiping your ID card 5 days a week, show up. Don’t let attendance be the reason you lose money.

- Upskill Aggressively: The market is hungry for AI, Cloud and Data Engineering skills. A certification in these areas can be your leverage during the next appraisal cycle.

- Understand Your CTC: Look closely at your offer letter. Know exactly what percentage of your salary is “fixed” vs. “variable”. A high variable component is risky in a slow market.

Conclusion: A Wake-Up Call for IT Professionals

The story of the TCS employee salary drop is more than just gossip; it’s a cautionary tale. It reminds us that in the private sector and financial growth is never on autopilot.

While TCS remains a top employer offering job security that startups can’t match, the policies regarding variable pay cuts and appraisal freezes are real. The days of getting a hike just for “being there” are over.

Stay relevant, stay compliant and keep a close eye on those payslips.

- Sunita Williams’ Secret: Astronaut Mindset That Builds Crores via SIP InvestingDiscover Sunita Williams’ astronaut mindset for wealth building: Solve crises “one bite at a time” like mutual fund SIP investing. Learn disciplined saving, risk pivots, and best mutual funds India strategies from her 27-year NASA career.

- HDFC Bank Q3 Surprise: Profit Jumps 11.5% – Why Experts Call It a ‘Screaming Buy’ at ₹930HDFC Bank’s Q3 FY26 results shine: 11.5% profit surge to ₹18,653 Cr, GNPA at 1.24%, deposits up 11.5%. Beats estimates amid deposit wars—strong buy for 2026? Stock eyes ₹1,000 breakout.

- Withdraw PF Money in Seconds? EPFO’s New UPI Update is the Game-ChangerDiscover EPFO UPI withdrawal: Instant PF access in minutes via PhonePe or Google Pay. Step-by-step guide, eligibility, benefits, and tax rules for 2026. Skip delays—empower your savings today!

- The Truth Behind the “TCS Employee Salary Drop”: Viral News, Variable Pay and What It Means for YouDiscover the real reasons behind the viral TCS employee salary drop. From variable pay cuts to strict WFO mandates and performance bands, learn why IT take-home pay is shrinking and how to protect your earnings effectively.

- This One No-Shop Weekend Hack Could Save You ₹50,000 Yearly—Here’s HowDiscover how one no-shop weekend monthly saves ₹50,000 yearly. Learn proven strategies to overcome impulse buying, build financial discipline, and transform weekend spending habits with our actionable no-spend challenge guide.

- The ₹1 Magic: Transform Pocket Change Into ₹1,378 With This Simple 52-Week PlanTransform your finances with India’s most popular 52-week money challenge. Save just ₹1 in week one, building to ₹52 by year-end for a total of ₹1,378. Discover the reverse challenge, practical tips, and how consistent saving habits create lasting financial freedom.

- Stop! Don’t “Liquidate” Your ₹500 Notes Yet: What the New RBI Circular Actually SaysGOI debunks viral ₹500 note discontinuation rumor. Fake news claimed RBI would ban notes by March 2026. Official clarification: ₹500 notes remain legal tender, ATMs continue dispensing them. Learn how to spot fake currency news and verify financial information.

- Cheques are Making a Huge Comeback in India—and They’re Now as Fast as UPI!India’s real-time cheque clearing system launched October 2025, processing cheques in hours instead of days. While Phase 2 was postponed, Phase 1 delivers same-day clearing with auto-approval features. Learn how continuous clearing speeds up banking for businesses and freelancers.

- You’re Already Using It: The Hidden ‘Embedded Finance’ Revolution Taking Over India in 2026India’s embedded finance market is exploding in 2026. Learn how UPI evolved into digital assets, BNPL transformed shopping, and financial services seamlessly integrated into your favorite apps. Discover five major trends reshaping how regular Indians manage money today.

- Forget 10% Salaries: Why 48% of India’s Gen Z are Starting SIPs with Just ₹500Discover how India’s Gen Z is building wealth with just ₹500 monthly SIPs. From ₹3 trillion in SIP inflows to 100 million active accounts, young investors are leveraging compound interest and disciplined investing to achieve financial independence without hefty salaries or trust funds.