Starting your career is an exciting milestone, but it also brings new financial responsibilities that can feel overwhelming. As a young professional earning your first substantial income, creating a budget isn’t just about managing money—it’s about building the foundation for lifelong financial success. With the average young professional in India earning between ₹3.41 lakh to ₹3.88 lakh annually, understanding how to allocate your income effectively becomes crucial for achieving your financial goals.

Why Budgeting is Critical for Young Professionals

The Power of Early Financial Habits

Your twenties and early thirties are the most critical years for establishing financial habits that will shape your entire future. Young professionals who start budgeting within their first two years of employment are significantly more likely to achieve major financial milestones like homeownership and retirement savings by age 40.

Common Financial Challenges You’ll Face

As a young professional, you’re likely dealing with unique financial pressures that older generations didn’t experience at the same scale. Student loans, increasing cost of living, delayed salary increments and the pressure to maintain a certain lifestyle while building savings create a complex financial landscape that requires strategic planning.

The average monthly salary for young professionals ranges from ₹25,000 to ₹32,000, but expenses in major Indian cities can quickly consume this income without proper planning. Additionally, the rise of digital payments, subscriptions, and easy credit access makes it easier than ever to overspend unconsciously.

Understanding Your Financial Position: The Foundation Step

Calculate Your True Monthly Income

Before creating any budget, you need to understand your actual take-home income. If you earn ₹30,000 per month gross, factor in deductions for EPF (12%), professional tax and income tax. Your net income might be closer to ₹26,000-28,000. This is the number you’ll work with, not your gross salary.

Track Your Current Spending Patterns

Spend one month tracking every expense, no matter how small. Use popular Indian apps like Walnut, Axio (formerly Walnut) or ET Money to automatically categorise your spending through SMS parsing. These apps are specifically designed for Indian banking systems and can track UPI transactions, card payments and even cash expenses when manually entered.

Identify Your Financial Personality

Understanding whether you’re naturally a spender or saver will help you choose the right budgeting method. Spenders might need stricter category limits, while savers might focus on optimizing investments and long-term goals.

The 50/30/20 Budget Rule: Your Starting Framework

50% for Needs: Essential Expenses

Allocate half your income to necessities that you cannot avoid:

- Rent/Accommodation: Maximum 25-30% of income (₹7,500-9,000 on a ₹30,000 salary)

- Food and Groceries: 10-15% of income (₹3,000-4,500)

- Transportation: 5-8% of income (₹1,500-2,400)

- Utilities and Phone: 3-5% of income (₹900-1,500)

- Insurance Premiums: 2-3% of income (₹600-900)

30% for Wants: Lifestyle Expenses

This category covers discretionary spending that enhances your quality of life:

- Entertainment and dining out (movies, restaurants, social activities)

- Shopping (clothing, gadgets, personal items)

- Subscriptions (Netflix, Spotify, gym memberships)

- Hobbies and personal development (books, courses, recreational activities)

20% for Financial Goals: Savings and Investments

This is the most critical category for long-term wealth building:

- Emergency Fund: 3-6 months of expenses (build this first)

- Systematic Investment Plans (SIPs): Mutual funds for long-term growth

- Public Provident Fund (PPF): Tax-saving long-term investment

- Debt Repayment: Student loans, credit card balances

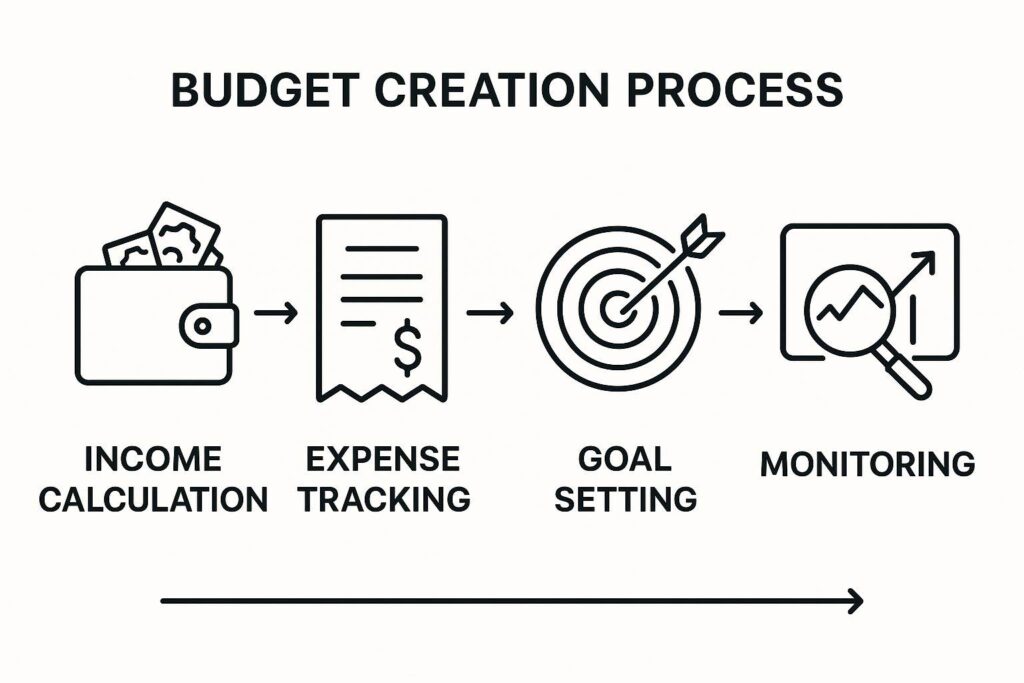

Step-by-Step Budget Creation Process

Step 1: Choose Your Budgeting Method

Zero-Based Budgeting: Assign every rupee a purpose before the month begins. This method works well for detail-oriented individuals who want complete control over their money.

Envelope Method (Digital Version): Allocate specific amounts to different categories and stop spending when the “envelope” is empty. Apps like Goodbudget digitize this traditional method.

Pay Yourself First: Automatically save and invest before allocating money to other categories. This works well for people who struggle with self-control.

Step 2: Set Up Automatic Systems

Create automatic transfers for savings and investments on your salary day. If you earn ₹30,000, automatically transfer ₹6,000 to savings and investments before you can spend it. This “pay yourself first” approach ensures you prioritize long-term goals.

Step 3: Create Spending Categories

Customize categories based on your lifestyle:

- Fixed Expenses: Rent, loan EMIs, insurance

- Variable Necessities: Groceries, utilities, transportation

- Discretionary Spending: Entertainment, shopping, dining

- Financial Goals: Emergency fund, investments, additional loan payments

Step 4: Use Technology to Your Advantage

Recommended Indian Apps for 2025:

- Walnut: Automatic expense tracking via SMS, budget limits, bill reminders

- ET Money: Combines expense tracking with investment options

- Money Manager: Simple UI with detailed transaction logging

- Axio: Comprehensive financial management with AI-driven insights

These apps integrate with Indian banking systems, understand UPI transactions, and provide insights specific to Indian spending patterns.

Common Budgeting Mistakes to Avoid

Mistake 1: Setting Unrealistic Budget Categories

Don’t allocate just ₹2,000 for food if you typically spend ₹5,000. Start with realistic numbers based on your current spending and gradually optimize.

Mistake 2: Forgetting Irregular Expenses

Budget for annual expenses like insurance renewals, festival shopping and vacation plans. Set aside money monthly for these yearly expenses.

Mistake 3: Not Building an Emergency Fund First

Before investing in mutual funds or buying gadgets, build an emergency fund of ₹50,000-75,000. This prevents you from using credit cards for unexpected expenses.

Mistake 4: Ignoring Small Recurring Expenses

Multiple small subscriptions can add up to ₹3,000-5,000 monthly. Audit your subscriptions quarterly and cancel unused services.

Advanced Budgeting Strategies for Career Growth

Salary Increment Planning

When you receive a raise, allocate the increase strategically:

- 50% to increased savings/investments

- 30% to improved lifestyle (better accommodation, food)

- 20% to discretionary spending

Side Income Integration

If you earn extra income through freelancing or part-time work, budget this money for specific goals like skill development courses, building an emergency fund or aggressive debt repayment.

Tax-Efficient Budgeting

Plan investments that provide tax benefits under Section 80C:

- EPF contributions (automatic)

- PPF (₹1.5 lakh annual limit)

- ELSS mutual funds

- Life insurance premiums

- Home loan principal repayment (if applicable)

Managing Money in the Digital Age

Dealing with UPI and Digital Payments

Digital payments make spending effortless but also invisible. Set up spending alerts on your banking apps and use expense tracking apps that automatically categorize UPI transactions.

Credit Card Management

Use credit cards for convenience and rewards, but pay the full balance monthly. Treat credit card spending as cash spending—if you don’t have the money in your account, don’t make the purchase.

Subscription Economy Navigation

Audit subscriptions every three months. Use apps like Truecaller Premium, Spotify, Netflix and gym memberships only if you actively use them. Consider family plans to reduce per-person costs.

Building Wealth Beyond Basic Budgeting

Start Investing Early

Even ₹2,000 monthly in equity mutual funds can grow substantially over 10 years with compound growth. Start SIPs immediately, even with small amounts.

Create Multiple Income Streams

Use your budgeting skills to manage income from primary salary, freelance work, investment returns and side business income.

Skill Development Investment

Allocate 5-10% of income to skill development—online courses, certifications, books or workshops that can increase your earning potential.

Seasonal and Cultural Considerations

Festival Budget Planning

Indian festivals involve significant expenses. Create a separate “festival fund” by saving ₹1,000-2,000 monthly for Diwali, weddings and other celebrations.

Annual Bonus Management

When you receive annual bonuses:

- 40% to emergency fund/debt repayment

- 30% to long-term investments

- 20% to major purchases you’ve been planning

- 10% for celebration/vacation

Monitoring and Adjusting Your Budget

Monthly Budget Reviews

Spend 30 minutes monthly reviewing your budget performance. Identify categories where you overspent and understand the reasons—was it a one-time event or a pattern that needs addressing?

Quarterly Goal Assessment

Every three months, assess progress toward larger financial goals:

- Emergency fund growth

- Investment portfolio performance

- Debt reduction progress

- Savings rate improvement

Annual Budget Overhaul

Completely review and update your budget annually, considering salary changes, lifestyle changes, new financial goals and economic conditions.

Conclusion: Your Journey to Financial Independence

Creating your first budget as a young professional is more than just tracking expenses—it’s about taking control of your financial future and building the habits that will serve you throughout your career. With the average young professional salary in India providing a solid foundation for wealth building, the key is starting early and staying consistent.

Remember that budgeting is a skill that improves with practice. Your first budget won’t be perfect, but it will be the beginning of a disciplined approach to money management that can lead to financial independence. Use the tools and strategies outlined in this guide, but adapt them to your unique situation and goals.

Start today, even if it’s with a simple expense tracking app and the 50/30/20 rule. Your future self will thank you for the financial discipline you build now. The habits you establish in your first few years of earning will determine whether you achieve your dreams of homeownership, travel, higher education or early retirement.

Take control of your financial future—create your first budget today and begin building the wealth that will give you the freedom to live life on your own terms.

- Sunita Williams’ Secret: Astronaut Mindset That Builds Crores via SIP InvestingDiscover Sunita Williams’ astronaut mindset for wealth building: Solve crises “one bite at a time” like mutual fund SIP investing. Learn disciplined saving, risk pivots, and best mutual funds India strategies from her 27-year NASA career.

- The ₹1 Magic: Transform Pocket Change Into ₹1,378 With This Simple 52-Week PlanTransform your finances with India’s most popular 52-week money challenge. Save just ₹1 in week one, building to ₹52 by year-end for a total of ₹1,378. Discover the reverse challenge, practical tips, and how consistent saving habits create lasting financial freedom.

- Forget 10% Salaries: Why 48% of India’s Gen Z are Starting SIPs with Just ₹500Discover how India’s Gen Z is building wealth with just ₹500 monthly SIPs. From ₹3 trillion in SIP inflows to 100 million active accounts, young investors are leveraging compound interest and disciplined investing to achieve financial independence without hefty salaries or trust funds.

- Is Your Credit Card Quietly Killing Your Score? The 30% Factor Lenders Watch CloselyCredit utilization ratio can quietly make or break your CIBIL score. Keeping card usage below 30% signals control, not desperation. With simple moves—mid‑cycle payments, spreading spends, and requesting higher limits—you can boost approval odds and pay less interest overall today.

- Need a Loan? Use These 7 No-Gimmick Tactics to Fix Your CIBIL Score in Just 30 DaysBoost your CIBIL score by 50+ points in just 30 days with proven tactics. Master payment history, reduce credit utilization, and dispute errors to unlock better loan approvals and lower interest rates. No gimmicks—just real strategies that work.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://bankermoney.com

Thanks for your feedback! Please reach me at avpatra09@gmail.com.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for your feedback! Please subscribe my channel for more such contents and share it with your friends and family. You may reach me at avpatra09@gmail.com

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://bankermoney.com

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Pingback: You’re Sitting on a Goldmine: How Your UPI History Can Help You Build Wealth