Navigating the world of banking in India can be confusing, especially with so many terms and acronyms used in everyday transactions. Whether you’re a student, professional, small business owner or simply managing your savings. Understanding these fundamental banking terms will help you make smarter financial decisions and avoid costly mistakes. Here are ten essential banking terms every Indian should know:

1. Savings Account

A Savings Account is the most common bank account for individuals in India. It allows you to deposit money, earn interest and withdraw funds as needed. Savings accounts are a safe place for your funds are often linked to your debit card and are ideal for managing daily financial needs.

2. Current Account

A Current Account is mainly for businesses and self-employed professionals that require frequent and large transactions. Unlike savings accounts, they don’t offer interest but provide unlimited transactions for operational flexibility. Overdraft facilities may also be available on these accounts.

3. ATM (Automated Teller Machine)

An ATM allows you to withdraw cash, check your account balance and perform other banking tasks without visiting a branch. ATMs are located across India in bank branches, malls and public spaces to be supporting your debit/credit cards for quick access to cash.

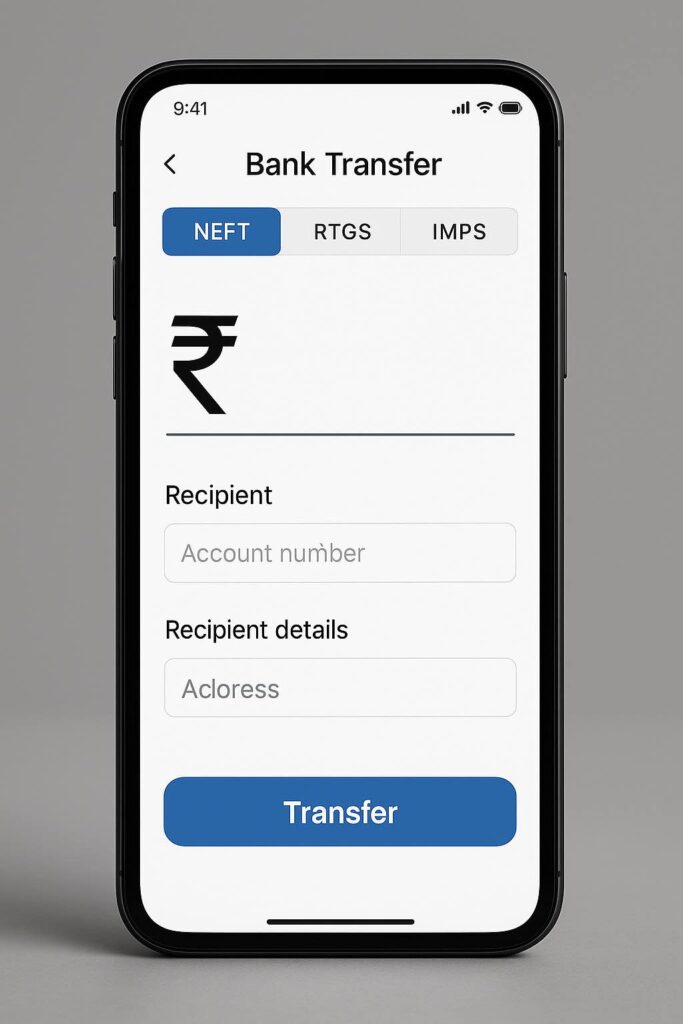

4. NEFT, RTGS, and IMPS

These are electronic payment systems that allow account holders to transfer money:

- NEFT (National Electronic Funds Transfer): Batch-processed transfers suited for non-urgent payments.

- RTGS (Real-Time Gross Settlement): Instant high-value transactions primarily for amounts above ₹2 lakh.

- IMPS (Immediate Payment Service): 24×7 instant transfer service even on holidays for urgent payments.

5. Cheque

A Cheque is a written order instructing the bank to pay a specific sum of money from the issuer’s account to the person named or bearer. Cheques are commonly used for payments and financial transactions between individuals, businesses and institutions.

6. Demand Draft (DD)

A Demand Draft is a pre-paid negotiable financial instrument issued by banks. Used for secure fund transfers, especially when the payee is in another city or is unknown to the payer. Unlike cheques, DDs are guaranteed by the issuing bank which reduces the risk of dishonor.

7. IFSC (Indian Financial System Code)

The IFSC is an 11-character alphanumeric code that uniquely identifies every bank branch participating in electronic payments systems like NEFT, RTGS and IMPS. It is essential for online fund transfers and can be found on your cheque book or via your bank’s website.

8. CRR (Cash Reserve Ratio)

CRR is the percentage of a bank’s total deposit that must be maintained in reserve with the Reserve Bank of India (RBI). It ensures banks have enough liquidity in the system and plays a critical role in monetary policy and inflation control.

9. Repo Rate

The Repo Rate is the interest rate at which RBI lends short-term funds to commercial banks. Changes in the repo rate directly affect loan and deposit interest rates across the country, influencing EMIs, savings rates and overall borrowing costs.

10. KYC (Know Your Customer)

KYC is the mandatory process banks use to verify a customer’s identity and address with documents like PAN, Aadhaar or Passport. KYC compliance is essential for opening accounts, investing and performing high-value transactions and helps prevent financial fraud and money laundering.

Final Thoughts

Mastering these ten essential banking terms will empower you to make better financial choices and confidently navigate the Indian banking system. Whether you’re opening your first savings account, sending an IMPS payment or applying for a loan, aware a basic grasp of banking terminology is vital for financial literacy and success.

- Is Your Credit Card Quietly Killing Your Score? The 30% Factor Lenders Watch CloselyCredit utilization ratio can quietly make or break your CIBIL score. Keeping card usage below 30% signals control, not desperation. With simple moves—mid‑cycle payments, spreading spends, and requesting higher limits—you can boost approval odds and pay less interest overall today.

- Need a Loan? Use These 7 No-Gimmick Tactics to Fix Your CIBIL Score in Just 30 DaysBoost your CIBIL score by 50+ points in just 30 days with proven tactics. Master payment history, reduce credit utilization, and dispute errors to unlock better loan approvals and lower interest rates. No gimmicks—just real strategies that work.

- Union Bank, BOI, and IOB: The Next Mega-Merger Wave is Coming. Here’s How Your Savings & Account Details Will ChangeIndia’s public sector banking faces a transformative merger wave. Finance Minister Sitharaman confirmed talks with RBI on consolidating 12 banks into six to seven globally competitive institutions. Expected announcements in April-May 2026 will reshape banking operations, employee roles, and customer services fundamentally.

- Don’t Panic: Why Your Bank’s Website Address Just Changed (and How to Tell if It’s Real)The Reserve Bank of India mandated all Indian banks migrate to the exclusive .bank.in domain by October 31, 2025, to combat rising digital fraud. This restricted domain provides verified security, SSL encryption, and DNSSEC protection, making it significantly harder for cybercriminals to create fake banking websites and phishing scams targeting unsuspecting customers.

- Why a Tiny $2.00 Bank Charge Could Be Your Biggest Warning SignReviewing your bank statements regularly and reporting lost cards immediately are your most powerful weapons against fraud. When you catch unauthorized transactions early, you’re already ahead of most fraudsters. Consumer fraud losses exceeded $12.5 billion in 2024, making vigilant account monitoring essential for protecting your financial security.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://bankermoney.com

Thanks for your kind words! Please reach me at avpatra09@gmail.com.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I like this weblog its a master peace ! Glad I found this on google .